In the power tool industry, the giant Emerson 2018 annual report was excerpted. However, the Emerson Group has a lot of business, and power tools are only a small part of it.

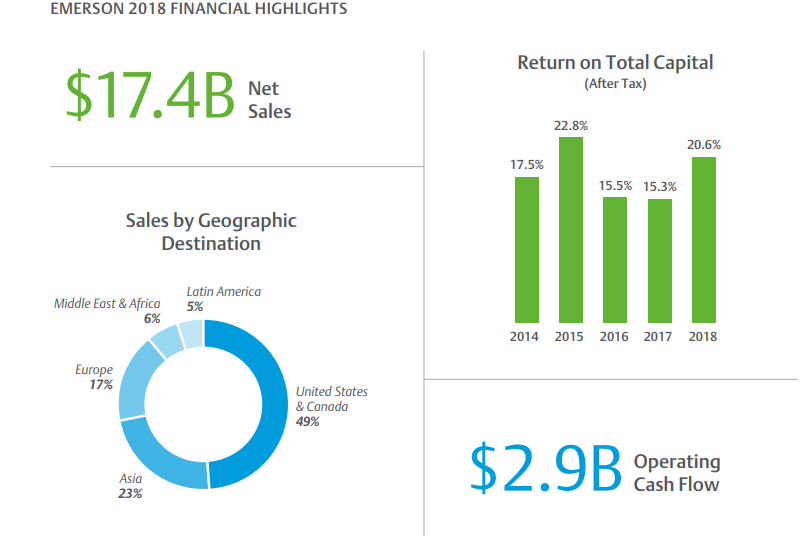

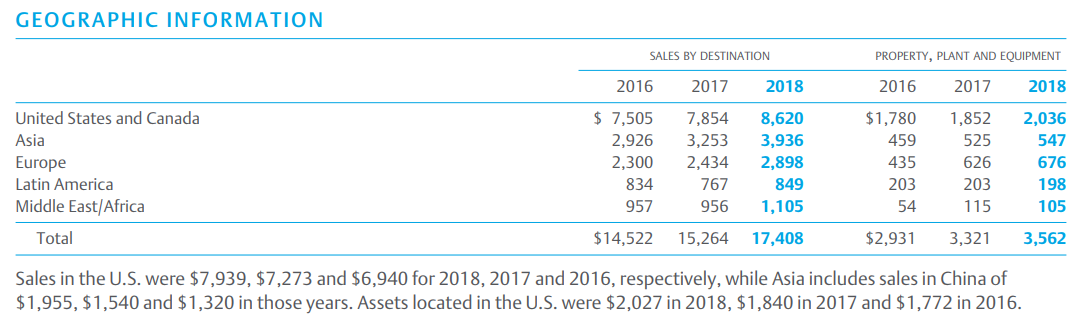

First, the overall sales in 2018 is 17.4 billion US dollars. According to the region, 49% in North America, 23% in Asia, 17% in Europe, 6% in the Middle East, and 5% in other regions.

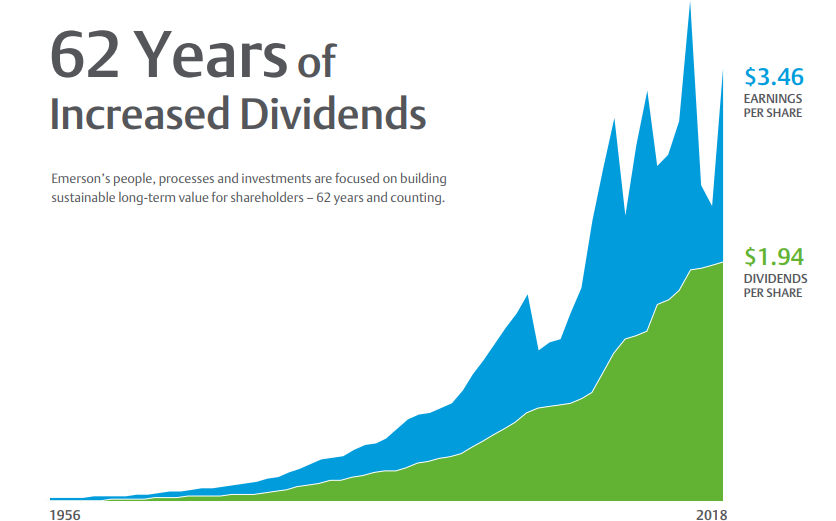

Since the 62 years, dividends per share have been increasing

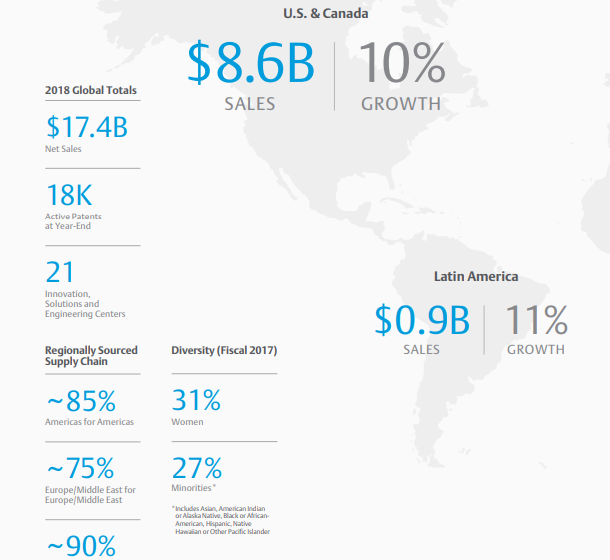

North American sales of 8.6 billion US dollars, an increase of 10%, of which the local supply chain in North America accounted for 85% (Europe, the Middle East local supply chain accounted for 75%).

Latin America sales of 900 million US dollars, an increase of 11%.

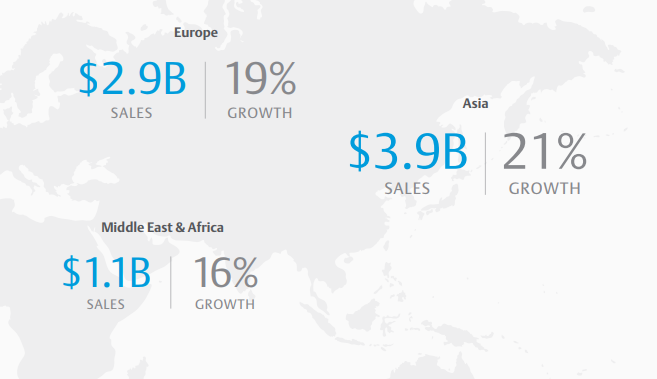

Europe sold 2.9 billion US dollars, an increase of 19%.

Asia sold 3.9 billion US dollars, an increase of 21%.

The Middle East and Africa region sold 1.1 billion US dollars, an increase of 16%.

Sales data for each region for 3 years:

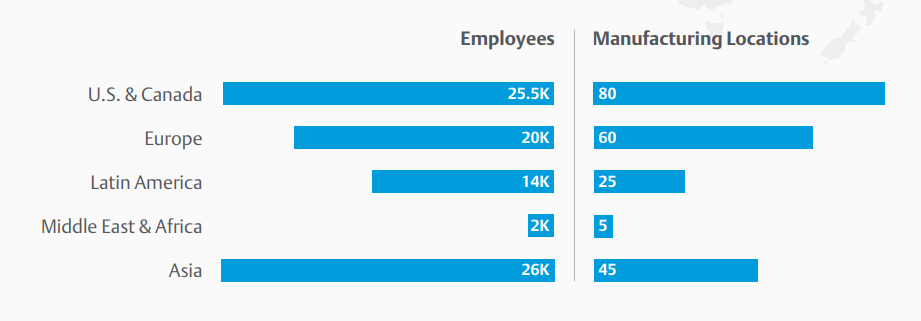

The employees said:

25,500 people in North America, 80 production bases

20,000 people in Europe, production base 60

14,000 people in Latin America, 25 production bases

Middle East, Africa 2000 people, production base 5

26,000 people in Asia and 45 production bases

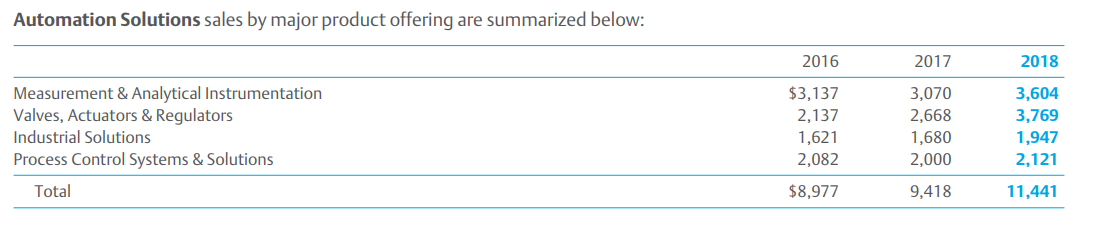

Sales segment of each business segment for 3 years:

Automation solutions: $11.441 billion in 2018

Commercial&residential solution: $5.982 billion in 2018, with Tool&home products (power tools and household products) operating at $1.528 billion.

The automation business is mainly divided into the following sections:

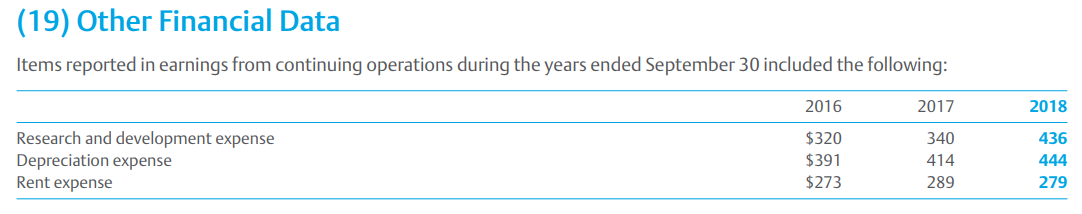

R&D expenses are $436 million in 2018

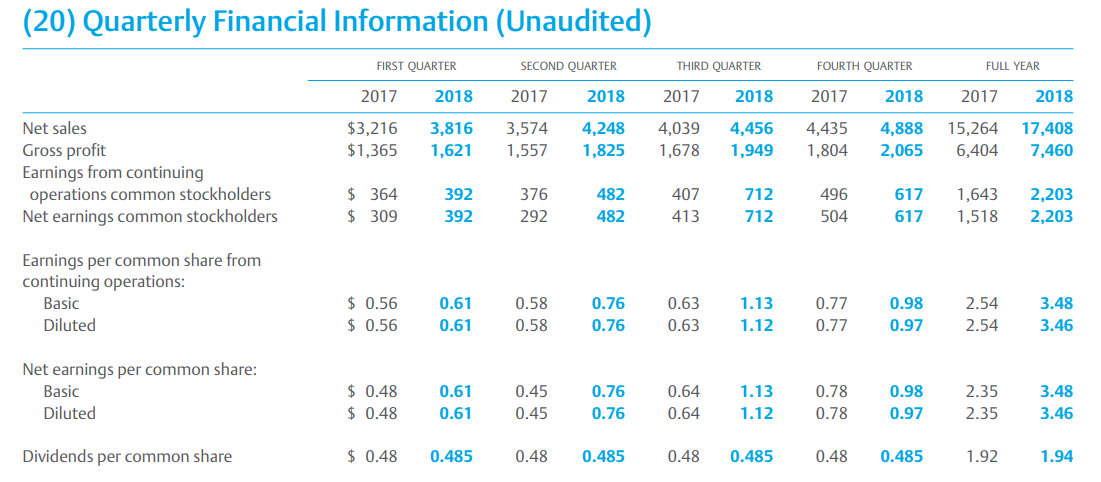

Summary of sales and gross margins for each quarter of 2017 and 2018 (unaudited).

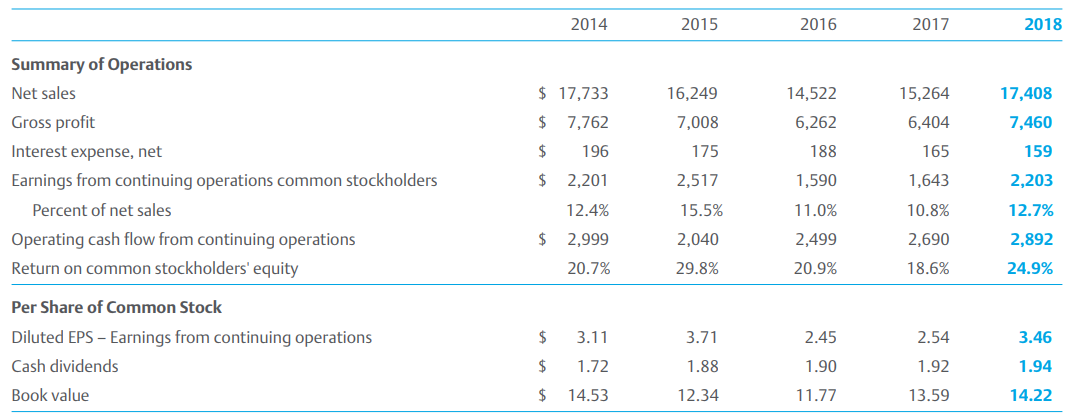

5 years of sales, gross profit margin, net interest rate and other data

Compound growth rate over the past few years

INTERNATIONAL SALES Emerson is a global business with international sales representing 54 percent of total sales, including U.S. exports. The Company generally expects faster economic growth in emerging markets in Asia, Latin America, Eastern Europe and Middle East/Africa. International destination sales, including U.S. exports, increased 18 percent, to $9.5 billion in 2018, reflecting increases in both the Automation Solutions and Commercial & Residential Solutions businesses.

U.S. exports of $1.1 billion were up 19 percent compared with 2017, reflecting increases in both Automation Solutions and Commercial & Residential Solutions which benefited from acquisitions. Underlying international destination sales were up 7 percent, as foreign currency translation had a 2 percent favorable impact, while acquisitions, net of the divestiture of the residential storage business, had a 9 percent favorable impact on the comparison.

Underlying sales increased 2 percent in Europe and 10 percent in Asia (China up 17 percent).

Underlying sales increased 4 percent in Latin America, 12 percent in Canada and 6 percent in Middle East/Africa. Origin sales by international subsidiaries, including shipments to the U.S., totaled $8.5 billion in 2018, up 19 percent compared with 2017, primarily reflecting acquisitions. International destination sales, including U.S. exports, increased 5 percent, to $8.0 billion in 2017, reflecting increases in both the Automation Solutions and Commercial & Residential Solutions businesses. U.S. exports of $927 million were up 4 percent compared with 2016, reflecting increases in both Automation Solutions, which benefited from the valves & controls acquisition, and Commercial & Residential Solutions. Underlying international destination sales were flat, as foreign currency translation had a 1 percent unfavorable impact, while acquisitions had a 6 percent favorable impact on the comparison. Underlying sales were down 1 percent in Europe and up 6 percent in Asia (China up 15 percent). Underlying sales decreased 12 percent in Latin America, 3 percent in Canada and 6 percent in Middle East/Africa. Origin sales by international subsidiaries, including shipments to the U.S., totaled $7.2 billion in 2017, up 6 percent compared with 2016, primarily reflecting the valves & controls acquisition.

ACQUISITIONS AND DIVESTITURES

On July 17, 2018, the Company completed the acquisition of Aventics, a global provider of smart pneumatics technologies that power machine and factory automation applications, for $622 million, net of cash acquired. This business, which has annual sales of approximately $425 million, is included in the Industrial Solutions product offering within the Automation Solutions segment.

On July 2, 2018, the Company completed the acquisition of Textron’s tools and test equipment business for $810 million, net of cash acquired. This business, with annual sales of approximately $470 million, is a manufacturer of electrical and utility tools, diagnostics, and test and measurement instruments, and is reported in the Tools & Home products segment.

On December 1, 2017, the Company acquired Paradigm, a provider of software solutions for the oil and gas industry, for $505 million, net of cash acquired. This business had annual sales of approximately $140 million and is included in the Measurement & Analytical Instrumentation product offering within Automation Solutions.

In fiscal 2018, the Company also acquired four smaller businesses, two in the Automation Solutions segment and two in the Climate Technologies segment.

On October 2, 2017, the Company sold its residential storage business for $200 million in cash, and recognized a small pretax gain and an after-tax loss of $24 million ($0.04 per share) in the first quarter of 2018 due to income taxes resulting from nondeductible goodwill. The Company realized approximately $150 million in after-tax cash proceeds from the sale. Assets and liabilities for this business were classified as held-for-sale in the consolidated balance sheet at September 30, 2017. This business had sales of $298 million and pretax earnings of $15 million in 2017, and was previously reported within the Tools & Home Products segment.

On April 28, 2017, the Company completed the acquisition of Pentair’s valves & controls business for $2.96 billion, net of cash acquired of $207 million, subject to certain postclosing adjustments. This business, with annualized sales of approximately $1.4 billion, is a manufacturer of control, isolation and pressure relief valves and actuators, and complements the Valves, Actuators & Regulators product offering within Automation Solutions. The Company also acquired two smaller businesses in the Automation Solutions segment. Total cash paid for all businesses in 2017 was $3.0 billion, net of cash acquired.

The Company acquired six businesses in 2016, four in Automation Solutions and two in Climate Technologies. Total cash paid for these businesses was $132 million, net of cash acquired. Annualized sales for these businesses were approximately $51 million in 2016.

See Note 3 for further information on acquisitions and divestitures, including pro forma financial information. See information under “Discontinued Operations” for a discussion of the Company’s divestitures related to its portfolio repositioning actions.