Hamiliton Beach was founded by Louis Hamilton and Chester Beach in 1900. In 1990, NACCO acquired Hamilton Beach from Glen Dimplex.

In 2017, NACCO split Hamilton Beach Company and listed it in the US independently, stock market code HBB.

At present, Hamilton Beach is mainly engaged in the business of small household appliances. The overall business is divided into two major blocks:

Hamilton Beach Brands and Kitchen Collen (kitchenware sales channels/stores)

Customers Consumer and commercial sales in North America are generated predominantly by a network of inside sales employees to mass merchandisers, e-commerce retailers, national department stores, variety store chains, drug store chains, specialty home retailers, distributors, restaurants, bars, hotels and other retail outlets. Wal-Mart Inc. and its subsidiaries accounted for 2 approximately 33% of HBB’s revenue in each of 2018, 2017 and 2016. Amazon.com, Inc. and its subsidiaries accounted for approximately 11%, 12% and 10% of HBB’s revenue in 2018, 2017 and 2016, respectively. HBB’s five largest customers accounted for approximately 54%, 55%, and 54% of HBB’s revenue for the years ended December 31, 2018, 2017 and 2016, respectively.

Product Design and Development HBB incurred $11.0 million, $10.4 million and $9.7 million in 2018, 2017 and 2016, respectively, on product design and development activities. Key Suppliers and Raw Material HBB’s products are supplied to its specifications by third-party suppliers located primarily in China. HBB does not maintain long-term purchase contracts with suppliers and operates mainly on a purchase order basis. HBB generally negotiates the purchases from its foreign suppliers in U.S. dollars. During 2018, HBB purchased 99% of its finished products from suppliers in China. HBB purchases its inventory from approximately 53 suppliers, one of which represented more than 10% of purchases during the year ended December 31, 2018. HBB believes the loss of any one supplier would not have a long-term material adverse effect on its business because there are adequate supplier choices available that can meet HBB’s production and quality requirements. However, the loss of a supplier could, in the short term, adversely affect HBB’s business until alternative supply arrangements are secured. The principal raw materials used by HBB’s third-party suppliers to manufacture its products are plastic, glass, steel, copper, aluminum and packaging materials. HBB believes adequate quantities of raw materials are available from various suppliers

KC operated 189 retail stores as of December 31, 2018. The stores sell kitchenware from a number of highly recognizable name-brands, including Hamilton Beach® and Proctor Silex®. KC sales accounted for 15.3%, 17.4% and 19.4% of the Hamilton Beach Holding’s annual revenue in 2018, 2017 and 2016, respectively.

Product Sourcing and Distribution KC purchases all inventory centrally, which allows us to take advantage of volume purchase discounts. KC purchases its inventory from approximately 176 suppliers, one of which represented approximately 25% of purchases during the year ended December 31, 2018. No other supplier represents more than 10% of purchases. KC believes that the loss of any one supplier would not have a long-term material adverse effect on its business because there are adequate supplier choices available that can meet KC’s requirements. However, the loss of a supplier could, in the short term, adversely affect KC’s business until alternative supply arrangements are secured. KC currently maintains its inventory for distribution to its stores at a distribution center located near its corporate headquarters in Chillicothe, Ohio.

Price range and positioning of various brands of Hamilton Beach.

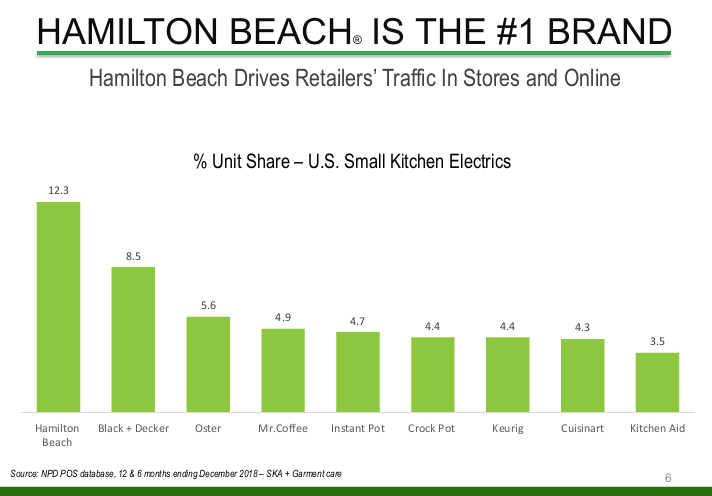

Comparison of Hamiton Beach and other competitors’ stores and network traffic.

HBB brand ranks in the top three in 28 small household appliances category

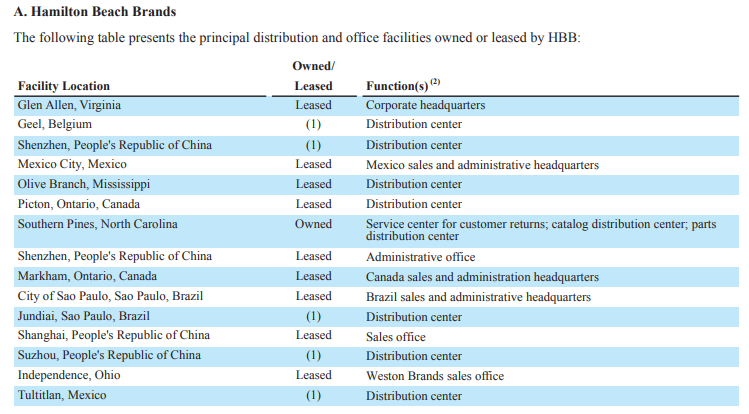

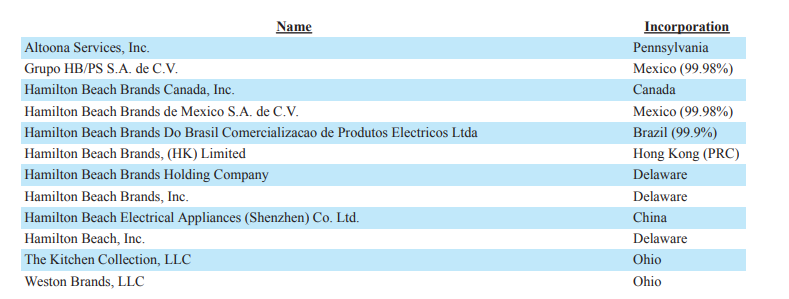

HBB’s branch and roles in various regions of the world:

Branch name:

Number of new product developments per year

Only-The -Best product strategy.

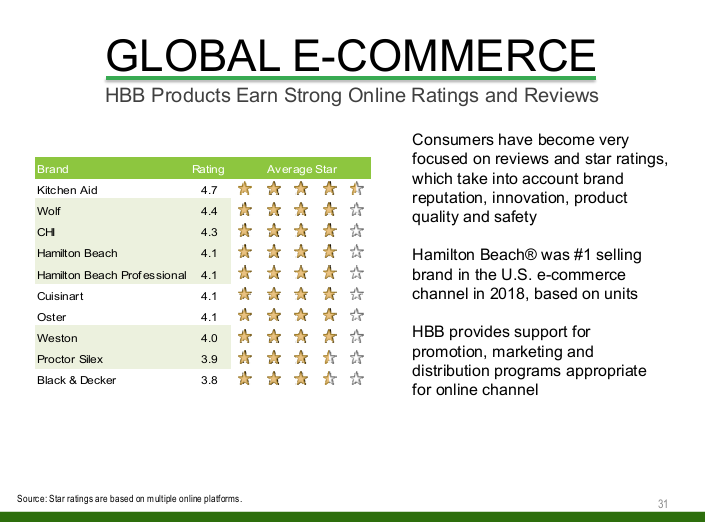

Global e-commerce helps HBB become an industry leader

Evaluation of HBB products in e-commerce

HBB’s long-term goal is to achieve $1 billion in sales.

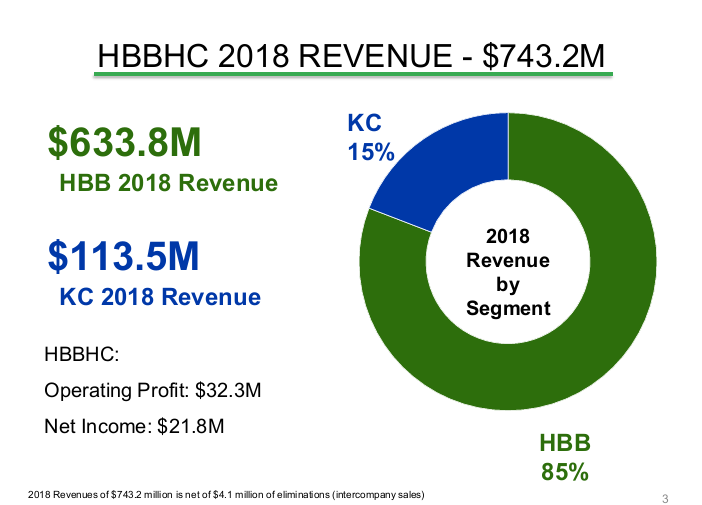

Sales in 2018 were $743 million, of which HBB was $633.8 million and KC was $113.5 million.

Global market strategy.

Sales in 2018 were $743 million and operating profit was $32.31 million.

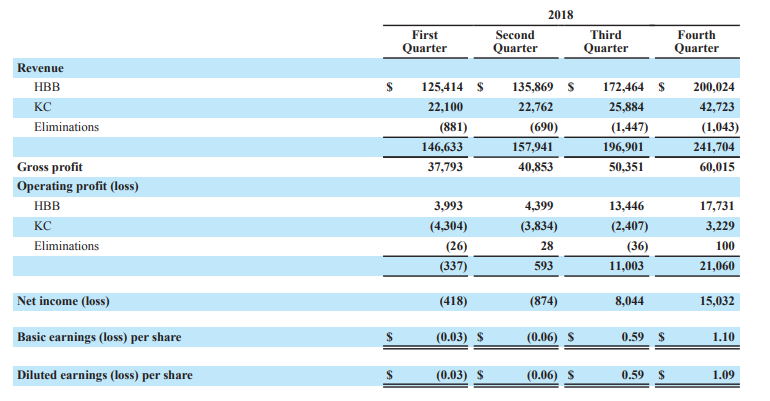

Distribution of sales for each quarter in 2018:

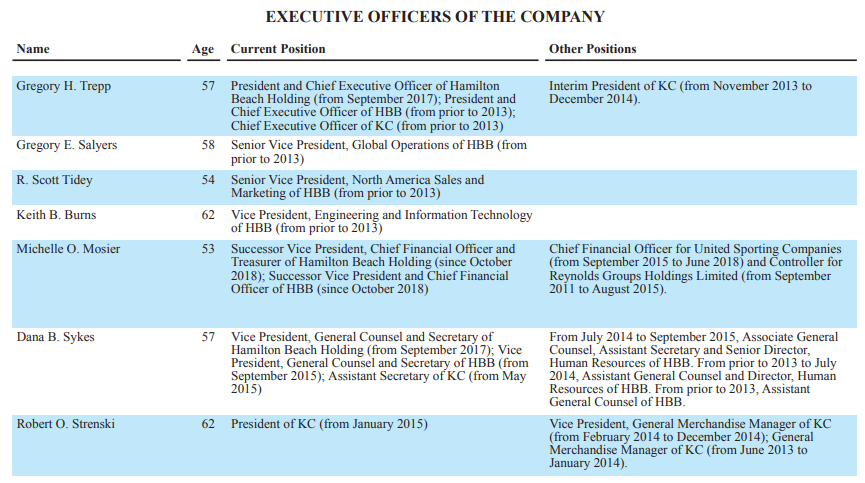

The company’s core executive list:

Among the income, the product sales revenue and Licensing income are distributed as follows:

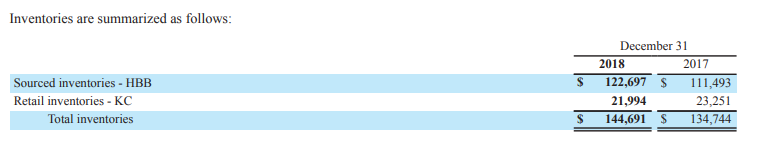

Stock quantity:

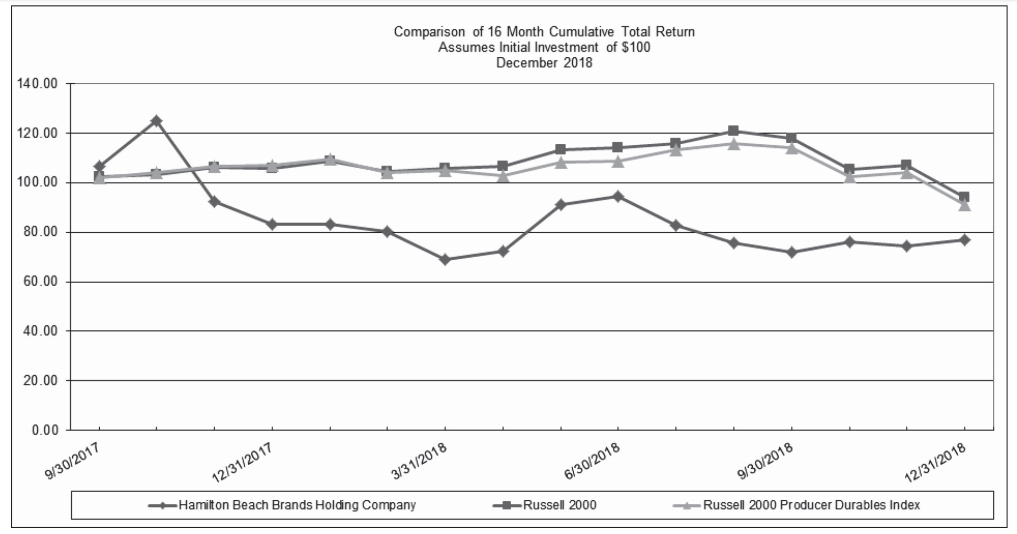

HBB and Russell 2000 other company index comparison.