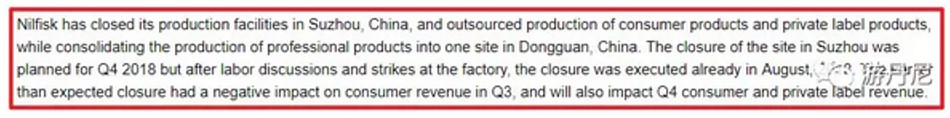

In 2018, Nilfisk Advanced Professional Cleaning Equipment (Suzhou) Co., Ltd. closed the Suzhou plant and transferred its operations to other sites.

Its ground cleaning equipment and high-pressure cleaners were respectively transferred to its own Viper factory in Dongguan and the uprising star Lutian Machinery.

Nilfisk, currently one of the leaders in the high-pressure washer, sold products of 190.9 million euros (about 1.5 billion yuan) in 2017. Yili, the largest washer maker in China, sold around one billion yuan of washers per year. Billion. Supported by Nilfisk, Lutian began to challenge Yili and Zhejiang Anlu, separately No.1 and No.2 household high-pressure washer makers. Nilfisk’s presence may change the washer industry pattern.

Danish company Nifisk was founded in 1906 by Peder Andersen Fisker and Hans Marius Nielsen. Nifisk was named based on Nielesen and Fisker. On the European continent, Nilfisk came first to sell vacuum cleaners.

The changes in Nilfisk’s product forms can be nosed through following events:

In 1910, Nilfisk produced the first vacuum cleaner C1 in continental Europe.

In 1955, the first floor cleaner debuted, and later Floor Care proved the paramount product line.

In 1955, the first floor cleaner debuted, and later Floor Care proved the paramount product line.

In 1958, Nilfisk began to produce the G70 vacuum with a dust bag.

In 1988, after acquiring the pressure washer brand Gerni, it entered the high-pressure washer market for the first time.

In 1989, NKT acquired Nilfisk.

In 1994, it acquired the American Advance Machine Company and began to enter the US professional cleaning market.

In 1998, it acquired EuroClean/Kent

In 2000, it acquired the Italian industrial vacuum cleaner manufacturer CFM

In 2004, it acquired the Italian road sweeper Ecological

In 2004, it acquired the Alto Group, which includes brands such as Alto, WAP, and Clark.

In 2005, Nilfisk set up factories in China and Hungary.

In 2007, it acquired the professional cleaning equipment company Dongguan Viper

In 2007, it acquired the professional cleaning equipment company Dongguan Viper

In 2008, it acquired Cyclone, an American outdoor cleaning equipment company

In 2011, it acquired the Danish outdoor cleaning equipment company Egholm

In 2015, it acquired American high-pressure cleaning equipment companies Hydro Tek and Pressure Pro.

In 2017, NKT A/S was split into two independent companies, and Nilfisk was listed in the Copenhagen stock market.

Through 100 years of development, Nilfisk has transformed its focus to industrial and professional cleaning equipment from household vacuum cleaner that is now of a little account.

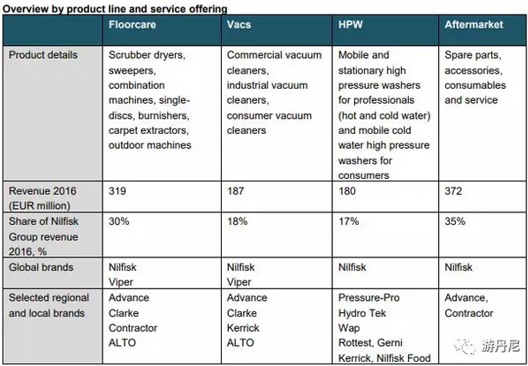

Nilfisk’s current product line comes in four major parts:

Floorcare: Scrubber dryers, sweepers, combination machines, single discs, burnishers, carpet extractors, outdoor machines

Vacs: Commercial vacuum cleaners, industrial vacuum cleaners, household vacuum cleaners

HPW: Professional-level pressure washer (hot and cold water) and consumer-level pressure washers

After market: accessories, etc.

Each product comes in Blue line and Grey line (no big difference except color). Welcome those from NILFISK to correct me if I am wrong)

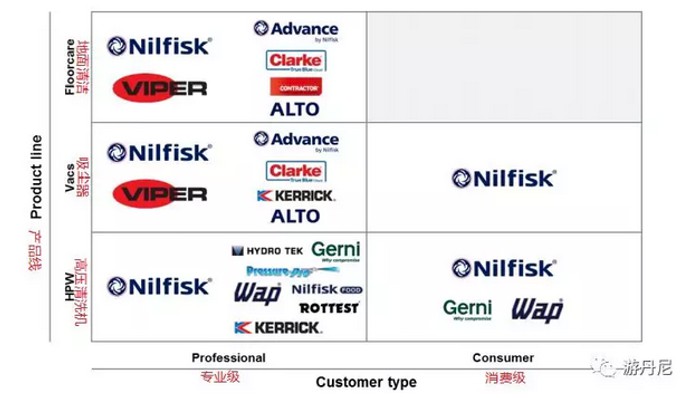

Nilfisk now possesses brands of Nilfisk and Viper as well as other regional brands, as follows:

Each brand is classified by the product lines, as follows:

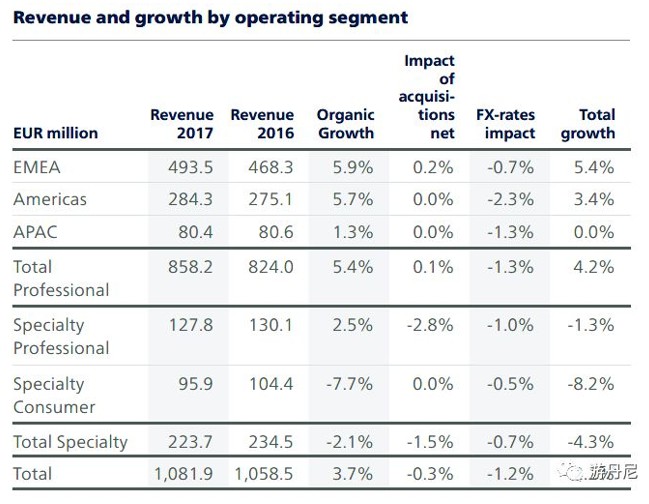

Nilfisk enjoyed sales in fiscal 2017 of 1.082 billion euros, a natural growth rate of 3.7%, as well as EBITDA of 11% and EBIT of 7.5%.

The complete sales data is as follows:

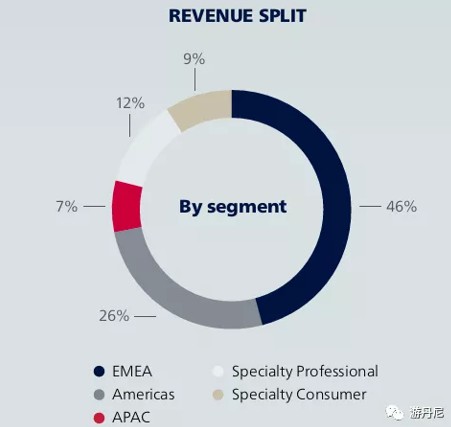

Sales in each region are shown below, with $493.5 million in EMEA, $284.3 million in Americas, and $80.4 million in Asia Pacific.

Regional sales are as follows:

The details of each market are as follows:

The EMEA market, including Europe, the Middle East and Africa, mainly Germany, France, the United Kingdom, Denmark and Sweden, saw annual sales of 494 million euros, contributing to 46% of the company’s sales. Floor care, after market, HPW and Vacs accounted for 31%, 35%, 17% and 17% respectively.

The America market, covering the North America and South America, mainly the US, Canada and Mexico, saw annual sales of 284 million euros, accounting for 26% of the company’s total sales. Floor care, after market, HPW and Vacs accounted for 52%, 27%, 13% and 7% respectively.

The APAC market, including Asia and the Pacific, mainly Australia, China, Singapore and Thailand, saw annual sales of 80 million euros, accounting for 7% of the company’s total sales. Floor care, after market, HPW and Vacs accounted for 33%, 34%, 16% and 16% respectively.

Specialty professional market, including industrial vacuum cleaners, outdoor equipment, repair equipment, food industry equipment, presented annual sales of 128 million euros. IVS, outdoor, food and Hydramaster accounted for 51%, 25%, 12% and 12% respectively.

The Specialty consumer market enjoyed annual sales of 96 million euros, including household vacuum cleaners, high pressure washers, and corresponding aftermarkets. The high-pressure washers, vacuum cleaners, others and the aftermarket contributed to 48%, 36%, 1% and 15% of sales respectively.

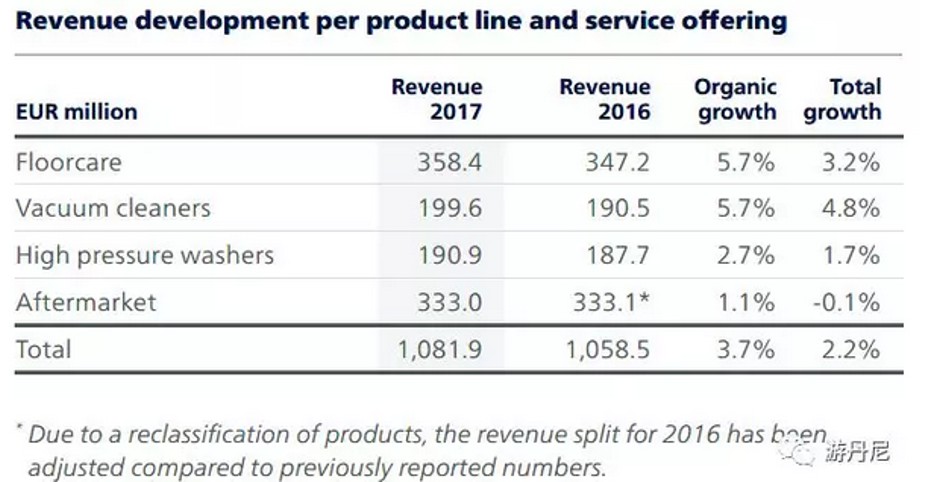

Sales for each product line are as follows: $358.4 million of ground care, $199.6 million of vacuum cleaner, $190.9 million of pressure washer, and $333 million of aftermarket.

Sales in various countries are as follows: US $275.9 million, Germany $118.4 million, France $104.6 million, UK $49.8 million, Denmark $48.3 million, Sweden $41.5 million, Australia $36.9 million, China $26.7 million, Netherlands $24.6 million, Norway $23.7 million and other regions $331.5 million.

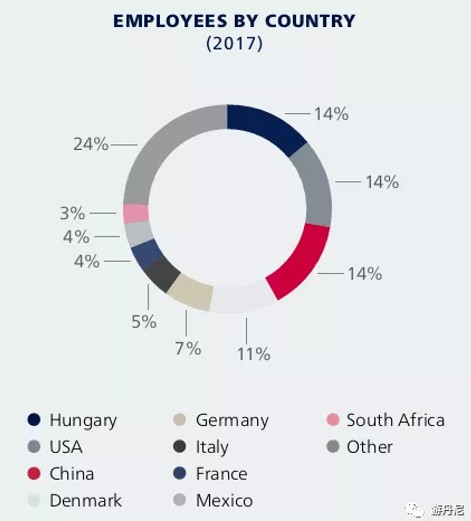

At present, Nilfisk featuring 5,800 employees and 45 sales companies and 17 production bases worldwide sells products to more than 100 countries. Its top ten clients contribute to 10% of its sales.

Its 5,800 employees are from different countries as follows:

Nilfisk has 17 manufacturing sites worldwide with corresponding products as follows (2017 data). Its production sites in Suzhou and Singapore closed in 2018.

The details of the operating expenses of the company are as follows:

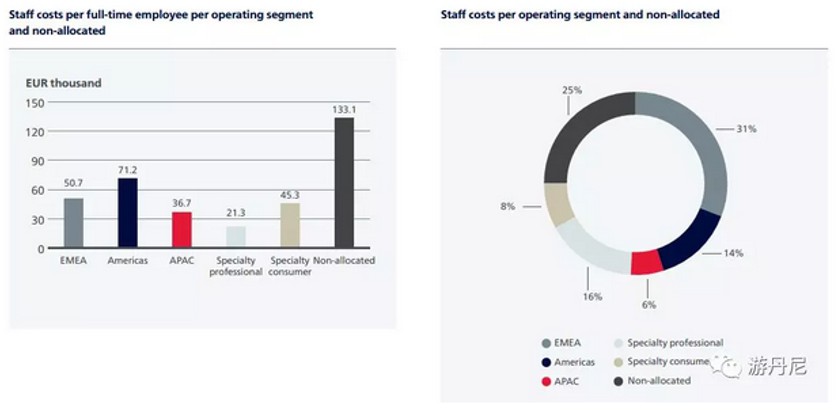

The staffing costs in each region are as follows:

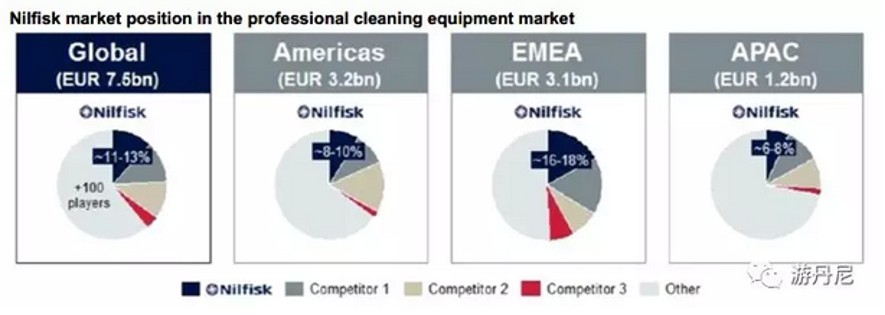

Nilfisk estimates 11-13% share in the global professional cleaning equipment market (according to 2016 sales estimates). Relatively fragmented, this market sees more than 100 brands in the globe, with the first four of Nilfisk, Karcher, Hako and Tennent. 20-25% are high-end products while 2-4% are terminal-end ones. Regionally, the sales contribution is: Americas 8-10%, the EMEA 16-18%, and the APAC market 6 -8%.

Nilfisk mostly features a rich variety of vacuum cleaners as far as I am concerned. Unlike the stereotyped bucket vacuum cleaners, Nilfisk created a multitude of styles.

For example, the following picture shows a vacuum cleaner device customized for the food industry.

Customized cleaning equipment for the pharmaceutical industry:

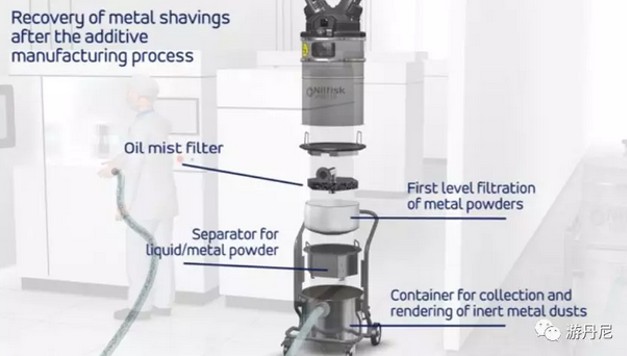

For example, the vacuum cleaner below has oil filter and water filter functions:

Vacuum cleaning equipment used in the construction industry:

There are other products showcased on Nilfisk.com. Once I met a US purchaser who wants possibly several hundred units of vacuum cleaners per year for the nuclear industry, yet one vacuum costs more than 10,000 yuan. Foreign buyers tend to face-lift HEPA and other parts of the bucket type model to pass the corresponding certification.

Nilfisk’s product line is worth learning from. Although the order quantity may not be so large, the profit must be pleasing.