The Small Domestic appliance Giant ,Group SEB has issue the 2017 grou Annual report.In this 320pages report,it contains a lot of inforations about the world SDA market,envirement,competiton.

I spend 1 weeks to summarize some of the important point with will including (This article totally around 7700words)

1.GROUP HISTORY

2.GROUP BRANDS

3.THE EXECUTIVE COMMITTEE

4.POSITION IN EACH MARKET AND CATOGORY

5.COMPETITION

6.SALES PERFORMANCE

7.RODUCT SALES PERFORMANCE

8.GEOGRAPHICAL PERFORMANCE

9.SALES BY DISTRIBUTION CHANNEL

10.SHARE HOLDERS STRUCTURES

11.ACQUISITIONS

12.GENERAL ENVIRONMENT

13.RAW MATERIALS AND TRANSPORT

14.INTEGRATION OF WMF

15.ONGOING INDUSTRIAL RESTRUCTURING IN BRAZIL

16.OUTLOOK OF 2018

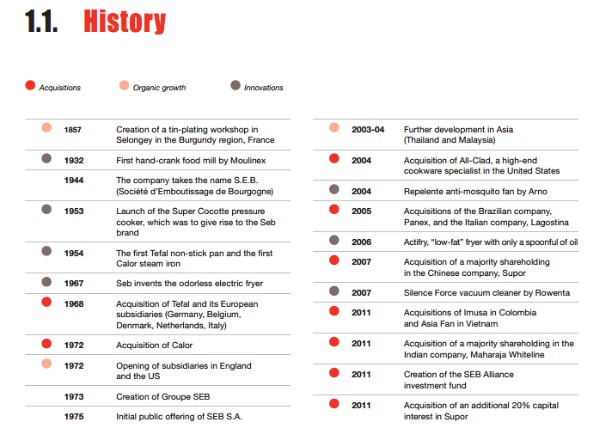

1.GROUP HISTORY

2.GROUP BRANDS :

Cord Brands:

Global :

Tefa,T-Fal,Reowenta,Moulinex,Krups

Regional :

Supor,Arno,Imusa,SEB,Calor,emsa,white Line,Mirro,Samurai,Wearever,Panex,Samurai,Rochedo,Clock,Esteras,Umco

Premium Brands:

WMF,Lagostins,All Clad,Silit

B2B brands:

WMF,Schaerer,Hepp

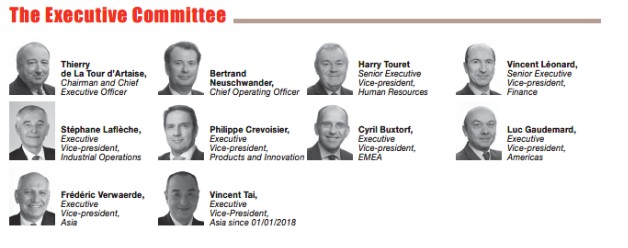

3.THE EXECUTIVE COMMITTEE

4.POSITION IN EACH MARKET AND CATOGORY

Groupe SEB has forged over the years a leadership position and a world reference status in Small Domestic Equipment. This sectorcovers cookware and small electrical appliances, accounting respectively for approximately 30% and 70% of its sales (excluding professional coffee).

The global Small Domestic Equipment market is divided into many distinct national and regional markets with their own local consumer cooking, eating and product utilization habits. It also lacks comprehensive coverage by research panels (primarily GFK) or other market research bodies. This at times makes it diffi cult to reconcile industry fi gures (inclusion of new categories or geographic segments, for example) in order to produce a global picture. Based

on the latest available statistics and Group estimates, the size of the market addressed is currently estimated at approximately €40 billion for small electrical appliances and €22 billion for cookware and kitchen utensils.

■ The small electrical appliances market targeted by Groupe SEB includes several segments varying considerably in size, and ranked below according to their overall weighting:

■ electrical cooking: rice cookers, electrical pressure cookers,multicookers, toasters, deep fryers, grills and barbecues,sandwich-makers, table-top ovens, induction hobs, etc.;

■ beverage preparation: kettles, coffee makers (filter and pod,espresso machines);

■ food preparation: blenders, kitchen machines, heating/cookingfood processors, beaters, mixers, citrus squeezers and juicers,etc.;

■ linen care: ironing (dry and steam irons, steam generators and garment steamers), semi-automatic washing machines, etc.;

■ personal care: hair care appliances (hairdryers, blow-drying hairstylers, hair straighteners), hair trimmers, depilators ,bathroom scales. The Group does not operate in the dental care

or men’s shaving segments which are accordingly excluded from its target market;

■ home care: vacuum cleaners;

■ home comfort: fans, heaters, air treatment appliances.Groupe SEB has built a global reference position in the small electrical appliance market that it addresses. This position is based on number one rankings in several categories, top-tier positions in others, and a reinforced presence in new product families.

■ The cookware and kitchen utensil market breaks down more or less evenly between the two segments. For cookware (mainly frying pans, saucepans, pressure cookers, bakeware and oven dishes) Groupe SEB is the undisputed leader and is continuing to expand its product offering by regularly introducing new materials.The kitchen utensil and accessories market includes, for example,spatulas, ladles, skimmers, kitchen knives, vacuum flasks and mugs, food storage boxes and containers, etc. By combining sustained organic growth and a strategy of industry consolidation exemplifi ed by the recent acquisitions of Swizzz Prozzz, EMSA and

WMF, Groupe SEB now ranks among the top fi ve global players in this segment. However, its share of this highly fragmented but extremely promising market remains limited.

At worldwide level and from a long-term perspective, the Small Domestic Equipment sector has demonstrated its resilience during periods of crisis and solid development within a neutral or positive economic environment. This performance refl ects the combined

impact of various factors:

■ global consumption trends driven by a growing interest in health and wellbeing, encouraging the development of “home-made” products;

■ moderate but steady growth in most mature markets, with a high installed base though unevenly spread across product families,responsiveness to innovation, a robust replacement market anda trading up trend refl ecting demand for higher status products.At the same time, the entry-level segment, driven by demand for basic, low-priced products, has remained steady;

■ overall solid but more volatile growth in emerging markets,according to the general environment and events. These markets are experiencing strong demand from fi rst-time buyers and their buoyant growth is fueled by rising consumption stemming from the

greater purchasing power of a booming middle class, increasingurbanization and the development of modern retail channels,particularly e-commerce;

■ the co-existence of “global” products addressing universal needsor easy to tailor on a country scale with a product offering adapted to the specifi c lifestyles and consumption habits (particularly in relation to food) in local markets;

■ an average sale price of around €50 for a small electrical appliance in Europe, for example, largely affordable by the general public and requiring no credit or a limited use of credit. Sales are further boosted by in-store or online traffic, driven by promotional campaigns within a very competitive market environment;

■ strong seasonality, shared by all market players, largely linked to the high percentage of products sold during holiday periods or for special events (back to school, Christmas, Chinese New Year,Singles’ Day, Black Friday, etc.);

■ strong contributions for many years from products and solutions developed in partnership with major consumer goods players, as for example in the case of single-serve coffee making.

5.COMPETITION

On top of these specific moves, changes in distribution are playing acrucial role in the emergence of new consumer purchasing behavior:the rapid development in many countries – mature and emerging –of alternative distribution networks, in particular e-commerce, has

profoundly transformed the market, boosting online sales (particularlyfor small electrical appliances), sometimes to the detriment of retail banners with a physical presence. As a result, growth in this market is currently being broadly driven by e-commerce: major online specialists (pure players like Amazon, Tmall, JD.com, Nova Pontocom, etc.) as well as the websites of initially “physical” retailers (“bricks-and-mortar”retailers).

MULTIPLE FORMS OF COMPETITION

In a global context, the very nature of the Small Domestic Equipment market requires a strategy that is both global and local in order to effectively address the expectations of consumers around the globe.The expansion of international brands, which can in some cases

be marketed under strong local/regional brands in their domestic market, falls in line with this two-pronged approach and combines the benefi ts of both economies of scale and solid positions in local markets. On this basis, Groupe SEB is the only player boasting such

broad international reach, supported by a portfolio containing a wealth of global brands and brands with local leadership positions.This gives it a strategic advantage versus a very disparate range of

competitors consisting of:

■ large global groups (with, for some of them, only a marginal exposure to the small electrical appliance sector) . Philips and Electrolux, for example, have a diversified product offering and

a huge international presence. These two players are joined by Spectrum Brands and Conair, which mainly roll out their product ranges in Europe and the US, while Bosch-Siemens and Braun (P&G) are principally active in Europe. De Longhi completes the list: this major player in coffee and food preparation is expanding its sectoral and international presence;

■ major cookware manufacturers marketing a broad product range internationally, such as the US group Meyer, and the German companies Fissler and Zwilling-Staub;

■ numerous international players in the highly fragmented kitchen utensils market, including Tupperware, Rubbermaid (Newell Brands), Ikea, Oxo (Helen of Troy), Thermos and Lifetime Brands;

■ groups or companies operating primarily in their domestic market or a small number of reference markets: Magimix,Taurus, Imetec, Severin, in particular, in several European countries;Arcelik in Turkey; Bork and Polaris in Russia; Newell Brands, which mainly addresses North America, Hamilton Beach Brands and SharkNinja on the American continent; Mallory, Mondial, Britania and Tramontina (cookware) in South America; and Panasonic in Asia;

■ local competitors, notably in booming Asian emerging markets (China, India and Indonesia), driven by buoyant domestic markets and, in the case of China, by growth in exports, both regionally (particularly South-East Asia) and worldwide. In China, the Group’s

main competitors are Midea and Joyoung for small kitchen electrics and ASD for cookware;

■ specialists concentrating on one or two product segments: in small electrical appliances with innovative technologies, for example Dyson and iR obot, or with high-end positioning, such as Vorwerk and Jura; and in cookware, for example the French company Le Creuset, which specializes in cast iron cookware;

■ private labels or white label goods in large part focused on aggressively priced entry-level products from Chinese subcontractors which, however, have a market share that is weak

overall in terms of small electrical appliances. Conversely, in cookware, the Group’s main competitors internationally are often private labels;

■ finally, certain companies’ activities and brands are present in both B2B and consumer segments, as in the cases of Kitchen Aid (Whirlpool), Magimix (Robot-Coupe), Jura, and Vorwerk, forexample.Generally speaking, in both small electrical appliances and cookware,

competition is intense and has been reinforced by additional pressure on prices exerted by retailers in order to maintain or boost traffic instores in response to strong momentum in on-line sales.

THE PROFESSIONAL COFFEE MARKET

The acquisition of WMF has represented a great opportunity for Groupe SEB to enter the highly attractive market of professional automatic coffee machines for hotels, restaurants, cafés, bakeries and convenience stores. On a professional coffee machine market worth nearly €8 billion globally (source: Estin & Co.), Groupe SEB has thus penetrated a

very specifi c segment: fully automatic machines, which represent approximately 25% of the total market (including equipment and services), and whose sales are driven by rapid growth in out-of-home consumption of speciality and premium coffees.The Group has positioned itself as the undisputed global leader in this high concentrated market segment through two brands, WMF and Schaerer. Franke, Thermoplan and Melitta are also global benchmark players, alongside more minor groups in this segment but with a strong presence in other categories (La Cimbali, Rancilio through the Egrobrand, and Jura).

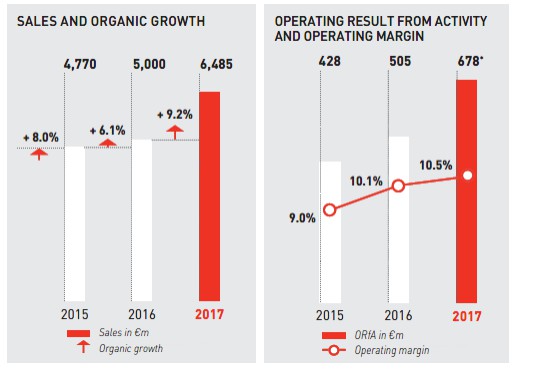

6.SALES PERFORMANCE

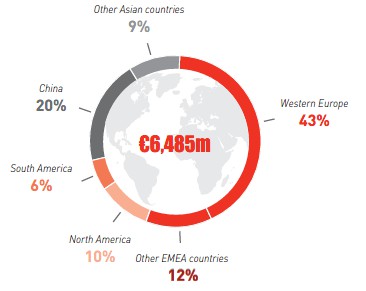

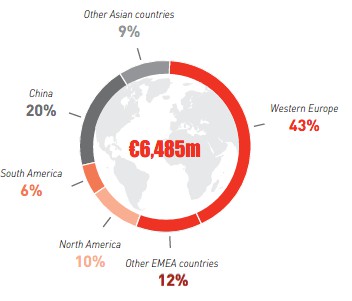

The Sales increase 9.2% from 2016 to 6.485 Billion Euro,Operating margin increase 10% to 678Million Euro.

Mature Market 59%,Emerging Markets 41%

Sales By regions:

Wester Europe 43%,Other EMEA countries 12%,North America 10%,South America 6%,China 20%,Other Asia countries 9%.s

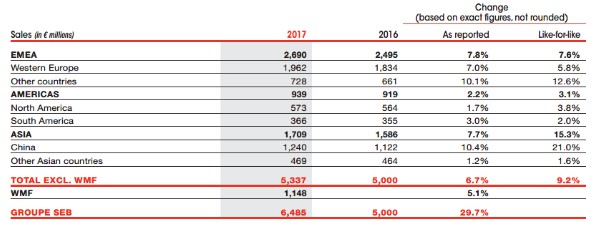

Sales in each area:

Over the last 40 years, the Group has successfully developed strong positions across all continents with a commercial presence in nearly 150 countries as a result of an expansion strategy combining internal growth with acquisitions. It has leading positions in Western Europe,China, Russia, Japan, Brazil, Colombia, Turkey, etc.The Group’s strong local presence is due to the relevance of its offering and its capacity to adapt to the needs of different markets. Its global presence enables it to seize opportunities for profi table growth in the various countries in which it has a presence, and to diversify its exposure to different economies. In 2017, 59% of its sales were generated in mature countries (53% excluding WMF) and 41% in

emerging countries (47% excluding WMF).

7.PRODUCT SALES PERFORMANCE

All the major product categories made a positive contribution to this strong sales performance:

■ despite high comparatives, the very strong dynamic continued in home care, with growth in activity of 30% on a like-for-like basis, driven by all the product families. Bagless vacuum cleaners are the main driver of growth, with further progress in Turkey, where the Group is expanding its product offering, including with locally manufactured products, and performing well in France, Spain,Germany and Russia, among others. Sales are also growing rapidly

and steadily in China. In Europe and Turkey, which has adopted European regulations on performance labeling of vacuum cleaners,the Silence Force 4A model is a big driver of growth. Meanwhile, the Clean and Steam vacuum cleaner has continued to grow, mainly in France and Italy.

Lastly, the launch of the Air Force 360 has enabled the Group to position itself in the new segment of versatile handstick vacuum cleaners with a high-quality model with robust sales, particularly in France, Germany and Spain. As in previous years, these excellent performances resulted in increased marketshare in fl oor care for the Group in Europe;

■ double-digit growth in food preparation with, as in 2016, contrasting situations according to product families: in blenders (the largest market in the category), the Group repeated the very good performance of 2016, due in particular to the very rapid growth of high speed blenders in China and the solid development of sales in South Korea and Mexico. In heating and cooking food processors, business was sustained despite the non-recurrence of a special operation on Cuisine Companion in Italy. The same was true of small food preparation appliances (beaters, hand blenders) and juicers. However, sales of soy milk extractors were down in China (due to strong competition from high speed blenders), but gradually recovered in meat mincers, sustained by a dynamic Russian market;

■ solid sales growth was registered in electrical cooking, covering nearly all the product families, except for deep fryers. Major contributors to this dynamic include rice cookers and electric pressure cookers in China – where Supor continues to stand out,thanks to continuous improvement in the functionality of its products– as well as multicookers, driven by Cookeo and Cookeo Connect,particularly in France. Known as Cook4me internationally, Cookeo is gradually being rolled out to other countries (e.g. Germany, Japan,and Australia). Optigrill has also confi rmed its success and has continued its geographical expansion (in Russia, for example).2017 was also a good year for informal meal appliances (including sandwich makers and waffle makers), and for toasters, driven particularly by the large-scale launch of a kitchen electrics range under the Krups brand in the US;

■ cookware sales were extremely positive, driven by an increase in the vast majority of countries, with the notable exception of two: the US, where the (perhaps temporary) emergence of new players has significantly disrupted the market in 2017 and adversely affected T-fal’s sales in North America; and France, due to the non-recurrence of a major loyalty program with a retailer in 2016. Excluding the US and France, buoyant sales of pots and pans refl ect both a solid core business (China, Germany, Japan, South Korea, etc.) and new loyalty programs in several countries (Germany, Central Europe,Mexico, etc.). It is also worth noting that the premium segment,served within the Group by All-Clad and Lagostina (and now also WMF), also performed well. Meanwhile, sales of kitchen utensils again registered strong growth, again largely driven by cups, mugs and thermal cups in China, but steadily expanding geographically;

■ the home comfort business registered solid growth in 2017 on a like-for-like basis. Sales of air purifi ers again grew rapidly, mainly in China. Fan sales suffered throughout the year from adverse weather conditions in Colombia and Brazil, but rebounded at the end of the year in Brazil, thanks to the launch of new large and ceiling models,which enabled 2017 to end in positive territory;

■ in linen care, organic growth was also pronounced, based on two main products types: steam generators – particularly fast-heating models – in France, Central Europe and Turkey, for example, and garment steamers (standing or handheld), with new advances in China, Japan and the US, which are fast-growing markets. However,sales of irons proved to be more diffi cult in an almost stable world market, despite clear commercial success in Russia and Brazil.The Group’s constant innovation and its ability to adapt to new uses and local needs (as was the case with the Freemove compactiron, launched successfully in Japan) have enabled it to strengthen its positions;

■ in the beverage preparation market, the Group maintained a steady pace of growth, thanks in particular to the major contribution of the new Nespresso contracts signed in Switzerland and Austria,as well as the strong performance achieved in Dolce Gusto coffee machines, whose product offering continues to expand. Sales of automatic espresso machines also continued to grow, particularly in Europe, and fi lter coffee makers benefi ted from the introduction of the new Krups range of kitchen electrics in the US. Kettle sales weredown, despite strong momentum in Japan, where the Group has strengthened its leadership, due to a very high 2016 comparison base in China. In home beer-tapping machines, BeerTender and Le Sub achieved a net increase in sales compared with 2016;

■ lastly, in personal care, sales were up slightly on a like-for-like basis, driven by male beauty appliances (mainly hair trimmers) and hair removal (a loyalty program with a retailer in France), while the Steampod professional hair straightener, designed in partnership with L’Oréal, again registered strong sales that were nevertheless down compared with an exceptional performance in 2016

8.GEOGRAPHICAL PERFORMANCE

EMEA

Western Europe

In a European market remaining overall sound, Groupe SEB achieved organic sales growth of 5.8% in 2017 and 8.1% in the fourth quarter. At year-end, and despite their different environments and high comparatives, almost all countries posted like-for-like growth. This

robust momentum translated into market share gains.The Group delivered record performances in France, with fourthquarter sales of €307 million (+4.7%) and full-year sales of €791 million(+1.4%). Despite a strong year-end, cookware revenue remained sluggish due to the non-repeat of loyalty programs. In small electrical appliances, however, business was excellent, driven by a broad range of products, including vacuum cleaners (bagless, uprights, the Clean & Steam model and the versatile stick Air Force 360),steam generators, Cookeo, the Cuisine Companion cooking food processor, full-automatic espresso machines, Dolce Gusto, etc., and led to a signifi cant improvement in our leadership on the French smallelectrical appliance market in 2017.In Germany, the Group’s 2017 performance was outstanding. Business was underpinned by the ongoing roll-out of fl agship products suchas Optigrill, Actifry, vacuum cleaners, coffee makers (full-automaticespresso machines, Nespresso and Dolce Gusto) and cookware – all boosted by major growth drivers – and was further bolstered by loyalty programs with retailers. The sharp increase in sales in Switzerland and Austria can be attributed to new partnerships with Nespresso.Despite the non-renewal of special sales campaigns in 2016, the Group also had a good year in Spain where its growth, fueled by

almost all categories, strengthened its leadership offl ine and online.

The core business, excluding special campaigns, was also very strong in Italy due mainly to the confi rmed success of vacuum cleaners,steam generators, Optigrill and Dolce Gusto, as well as our continued headway in e-commerce. In the United Kingdom, despite an uncertain

overall environment and the price hikes implemented to offset the depreciation of the pound sterling, Group revenue was up like-forlike.In Belgium, the Netherlands and Portugal, the Group achieved a very good year.Moreover, 2017 was the fi rst year of consolidation for WMF, with, inparticular, the progressive takeover of the operational management of WMF’s Consumer business by Groupe SEB market companies, apart from Germany, Austria and Switzerland. These fi rst reorganization steps naturally caused some temporary disruptions but put the Group on the right track for 2018, with powerful action plans to roll-out and accelerate revenue synergies.

Other countries

In the other EMEA countries, the Group’s organic growth stood at12.6% for the year, following a fourth quarter posting a still solidgrowth of +7.4%. The vast majority of countries contributed to thisvery good performance which, as was the case in Western Europe,led to market share gains.The Group continued to make headway in Central Europe in2017, through a combination of development of its core business,underpinned by mainstay categories and supported by strongmarketing campaigns, and special sales campaigns with retailers.Our sales in Ukraine have grown tremendously on a quarterly basis and rose by more than 50% at constant exchange rates for the fullyear. Momentum slowed signifi cantly in the fourth quarter in Russia,

due mainly to the non-repeat of loyalty programs in cookware, but the vigorous growth in core business held steady, driven by all categories except coffee makers, by considerable gains in retail and by the ramp-up in our network of proprietary stores. In Turkey, the continued depreciation of the Turkish lira led us to increase prices substantially.However, sales in volume remained resilient, in both cookware (due in particular to the launch of Ingenio in fourth-quarter) and small electrical appliances, with a strong contribution from vacuum cleaners. Special emphasis should be given to the increasing weight in the business of products manufactured locally or at our plant in Egypt.

The fourth quarter showed growing sales in Saudi Arabia – despite still high inventories at our distributor’s – and stable revenue in India in a wait-and-see market context. Nonetheless, the improving trend could not compensate for the decline in turnover accumulated since the beginning of the year.

AMERICAS

North America

After 4.2% organic growth in the fourth quarter, the Group’s 2017 sales were up 3.8% like-for-like in NAFTA countries. This improvement can be attributed to a positive performance in the United States in thefourth quarter and to a good year-end in Canada.

In the United States, despite the favorable impact of the launch of the new Krups kitchen electric range, in particular in the fi rst quarter, the Group had a challenging year: diffi culties or weaknesses at several retail brands in light of fast-rising e-commerce; sales of core-range

cookware (T-fal) disrupted by a fi erce competitive backdrop; decline in the market of irons, not offset by sharp impetus in garment steamers,etc. While these factors were still relevant at the end of the year, growth resumed in the fourth quarter thanks to the replenishment of Krups

products, the rapid development of our sales with online pure players as well as strong momentum in the premium cookware segment with All-Clad and the introduction of the Lagostina brand. Consequently,full-year turnover was stable in dollars.

In Canada, as expected, fourth-quarter sales benefi ted from a more favorable momentum thanks to better cookware sales and solid growth in linen care (generators and garment steamers). Nevertheless,the overall environment remains complicated, especially in the retail

industry.

Mexico is the key contributor to growth in the NAFTA region in 2017.In spite of the earthquake’s impact on consumption, business dynamic remained quite robust in the fourth quarter, driven in particular by cookware, blenders and irons, as well as by a new loyalty program with one of our key clients.

South America

The turnaround in the exchange rate trend that began in the summer was confi rmed in the fourth quarter, with a signifi cant depreciation of the Brazilian real and the Colombian peso against the euro. However,the Group achieved over the period a somewhat fi rmer business

activity.

The Brazilian economy is showing signs of recovery, which materialize in household consumption, but the overall environment and the political agenda are key uncertainties. The Group posted organic sales growth in the fourth quarter of 3% which contributed to a slight

annual increase of 1%. This positive trend was driven mainly by fans and irons – due to new product launches – while sales were down in food preparation and cookware. With cookware manufacturing still in the transfer phase, the segment should soon benefi t from the new,

more competitive production lines at the Itatiaia site.

In Colombia, the decrease in sales in pesos continued to stem primarily from the drop-in fan revenue due to poor weather. In contrast, cookware business remained on track and growth was maintained in blenders. Moreover, the Group achieved a very good year in Argentina and ensured, despite high infl ation, a double-digit growth in unit sales.

ASIA

China

With sales growing organically at around 20%, both in the fourth quarter and over the year, the Group has again recorded a remarkable performance in China, in a market largely driven by e-commerce and which is creating value. Supor continued to implement an innovation

strategy and contribute to the trade-up of the market in its flagship products in cookware and kitchenware (woks, thermal flasks and mugs, in particular), kitchen electrics (rice cookers, electrical pressure cookers, high-speed blenders, etc.) as well as in the non-kitchen

small electrical appliance segment (air purifi ers, irons and garment steamers, vacuum cleaners). Internet sales continued to expand, and e-commerce accounted for more than 35% of 2017 revenue, bolstered by a Double 11 day progressing by more than 40% against 2016. All these outstanding performances of Supor must be put in perspective of a rich sales history including several years of double-digit organic growth.It should be noted that, to better refl ect the nature of some expenditure and ensure full consistency with other Group entities in terms of financial statements, an adjustment was made to the accounting format in 2017, whereby for full-year, €74 million in marketing spend was reclassifi ed as a sales decrease (of which €20 million in the fourth quarter), with no impact on Operating Result from Activity.

Other Asian countries

The fourth quarter was slightly down like-for-like in Asia excluding China, refl ecting the diverse situations in different countries. While Japan and South Korea, the Group’s two largest markets in the region,confirmed their role as strong drivers, momentum slowed somewhat in Australia and business was down – sometimes signifi cantly – in other countries that account for a very small percentage of sales.

In Japan, the Group maintained in the fourth quarter a solid growth rate, grounded in its three mainstays: cookware and kitchen tools;linen care, with continued progress in the expanding garment steamercategory and the promising launch of the Freemove Mini compact cordless iron; and kettles, where the robust improvement in sales further strengthened our leadership on the market. This strong momentum was fueled throughout the year by substantial growth

drivers. In addition, the excellent performance of our network of about 30 proprietary stores (with six openings in 2017) should be highlighted.

In South Korea, as in 2016, the Group had another good year in 2017,mainly owing to the ongoing business development in cookware,blenders and hair dryers. In Australia, after a vigorous third quarter boosted by the introduction of new products, growth in local currency slowed at the end of the year. Sales nevertheless remained on track, in particular in cookware, irons, electrical pressure cookers and Optigrill.

In the other South-East Asian countries, however, 2017 performances were very mixed: revenue improved on a like-for-like basis in Thailand and Malaysia after double-digit growth in the fourth quarter but fell sharply in Vietnam and was penalized by high 2016 comparatives in Singapore (non-recurring B2B campaigns).

WMF

WMF’s 2017 sales stood at €1,151 million, up 5.5% year-on-year. Inthe fourth quarter, WMF’s sales amounted to €338 million, practicallystable versus 2016.

In the professional business, WMF’s annual sales were €563 million, up 13%, with coffee (PCM) contributing +17% and the hotel equipment business down 9% due to the lack of major projects compared with 2016. Turnover for the fourth quarter stood at €137 million and was stable. For professional coffee machines in particular, as has been specifi ed throughout the year, the 2017 performance should be analyzed from two perspectives: on one hand, a core business that continued to grow at a sustained pace in both Germany (with strong year-end momentum) and internationally; on the other hand, the major impact of two large contracts signed in 2016 with Canadian and Japanese clients, but which gradually faded: as most of the deliveries were made between fourth-quarter 2016 and the summer of 2017,the effect strongly mitigated in the third quarter, before disappearingentirely in the fourth quarter.

In the Small Domestic Equipment business (“Consumer”), sales amounted to respectively €588 million and €201 million for full-year and fourth-quarter, almost unchanged versus 2016, due to a combination of several factors: still sluggish cookware sales in Germany, the nonrepeat

of a major loyalty program of end-2016 in Asia and one-off disruptions caused by the sales reorganizations outside of Germany,Austria and Switzerland. However, growth in sales of small electrical appliances was in the double digits fueled in particular by new product launches; WMF stores achieved a slight growth in sales in Germany; and lastly, international expansion is progressing rapidly.

9.SALES BY DISTRIBUTION CHANNEL

A MULTI-CHANNEL DISTRIBUTION STRATEGY

The Group works with an extremely large and diverse network of distributors, giving it a decisive competitive edge. It develops constructive long-term relationships with customers on the basis of the most extensive product offering on the market and with strong brands, which are vectors of growth and profi tability for each of the parties.

The network mainly comprises mass food retailers, specialist retailers as well as convenience stores or groups of independents, of which there are still overweighted in emerging markets . The percentage of online sales continues to grow rapidly (representing close to one quarter of sales in 2017), driven by both e-commerce specialists (pure players) and bricks-and-mortar retailers, including specialist brands, as they ramp up their online presence (click-and-mortar).

In addition, the Group also has a network of stores, either directly operated or under franchise, numbering more than 1,200 at the end of 2017: their positioning may be multi-brand (Home & Cook and Tefal Shops) or mono-brand (Supor Lifestores and, more recently, WMF).This network, which is the Group’s biggest customer, represents nearly 7% of consolidated sales, but may exceed more than 20% in some countries (e.g. Turkey and Japan). These stores showcase the diversity of the Group’s offering and represent a unique opportunity to get close

to the consumer and improve our understanding of market trends.

Customer relations is one of the Group’s core concerns and it seeks operational excellence both in the supply chain, to guarantee the best levels of service, and in-store, to ensure that its products are promoted on its customers’ shelves and websites.

This approach is supported by investment in marketing and advertising, which has been signifi cantly strengthened in recent years: excluding WMF, it amountedto €480 million in 2017 (including €74 million in expenditure reclassified from Supor), compared to €435 million in 2016. The objectives remainas follows:

■ further strengthen brand and product recognition through advertising;

■ continue to roll-out of the best in-store execution through category management, effective merchandising, the creation of dedicated shop-in-shops and promotional events;

■ guide and support the Group’s new product launches;

■ accelerate digital marketing (brand websites, digital campaigns, data marketing, etc.) and support the ramp up of e-commerce. Excluding WMF

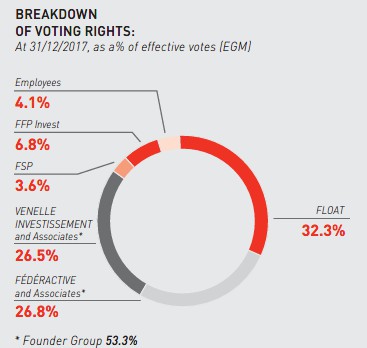

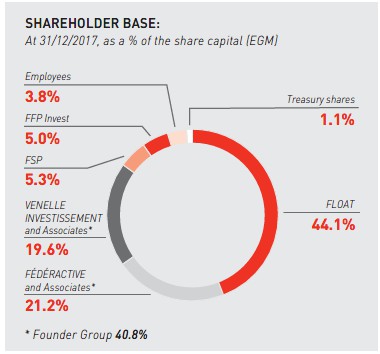

10.SHARE HOLDERS STRUCTURES

11.ACQUISITIONS

Acquisitions are another pillar of the Group’s development strategy.As an operator in the Small Domestic Equipment market, which is still highly fragmented, the Group is positioning itself as the industry consolidator. The Group’s history is one of numerous transactions which have enabled it to achieve leadership status in many countries and product categories.

In addition to having the necessary financial capacity, external growth requires an ability to integrate new acquisitions effectively and to generate synergies. Groupe SEB has built up considerable experience over the years in integrating new acquisitions. Following Moulinex-Krups in 2001-2002, it acquired All-Clad in the United States in 2004, Panex in Brazil and Lagostina in Italy in 2005, Mirro WearEver in the United States in 2006, and acquired a controlling interest in China-based Supor in late 2007. The latter stood out because of the major challenges it presented (geographical and cultural remoteness, language barrier, more complex integration, coordination of communications between two listed companies, etc.). The Group’s stake was increased in several stages (20% in December 2011, 1.6% in January 2015, and 7.91% in June 2016) bringing its current holding up to 81.17%.

Furthermore, in February 2011, the Group acquired Imusa, a Colombian cookware company. In May 2011, it took control of a Vietnamese company – Asia Fan – specializing in the production and sale of fans, and in December, it acquired a 55% stake in an Indian company – Maharaja Whiteline – specializing in small electrical appliances. In 2014, it announced the acquisition of the remaining shares of Maharaja Whiteline and Asia Fan. In 2015, it acquired

OBH Nordica, a major operator in small electrical appliances in the Scandinavian markets.

2016 marked a new stage for the Group with two strategic acquisitions in Germany in May.

The Group first acquired EMSA, specialized in the design,manufacturing and distribution of kitchen utensils and accessories.EMSA is a well-known brand in German-speaking countries and is the market leader in thermoware and food storage containers in Germany .EMSA also operates in the rest of Europe and the Middle-East. It reported €85 million in sales in 2016.

This was followed by the acquisition of WMF, a German industrial flagship with three major business lines: professional automatic coffee machines, Small Domestic Equipment (cookware and small electrical appliances) and hotel equipment.

Through this strategic acquisition,Groupe SEB:

■ acquired a solid worldwide leadership in the very attractive professional coffee machines market characterized by strong growth, high profi tability and signifi cant recurring revenue refl ecting important contributions from after-sales operations;

■ considerably strengthened its position in the cookware segment by becoming the leader in Germany, with, in particular, a high-end stainless steel product offering;

■ gave a further boost to its development, following EMSA’s acquisition, in the key kitchen utensils and accessories market;

■ consolidated its portfolio by adding strong new brands including the iconic WMF as well as Schaerer, Silit, Kaiser, and Hepp;

■ accessed a network of 200 proprietary retail outlets in Germany,providing a powerful vehicle for promoting its image and sales.In 2017, the Group continued its expansion in kitchen utensils with the acquisition of Swiss company Swizzz Prozzz, a specialist in mini hand choppers with high-performance multiple blades. Swizzz Prozzz’s products, which are very complementary to those of the Group, had previously been marketed under license through various kitchen utensil brands, generating pro forma annual sales of around €10 million

12.GENERAL ENVIRONMENT

In 2017, the Small Domestic Equipment market once again performedwell and even accelerated in the great majority of countries. Thefew major declining markets included: the UK, which remains in anuncertain position after the Brexit vote (lower household confi dence

and renewed infl ation following the depreciation of sterling), and Japan, whose recovery in consumption has only been very gradual,despite budgetary stimuli.

Outside the United Kingdom, the economies of the eurozone remained generally well-oriented and benefited from firm consumption (an almost universal increase in employment and wages) and even robust consumption in some countries (e.g. Germany, Spain, Portugal, and France). In a competitive and promotional context, the Small Domestic Equipment market in this area continues to be driven by innovationand upscaling.

In the United States, despite consumer confi dence, the Small Domestic Equipment market reflects a marked dichotomy between rapid growth in online commerce and an unprecedented crisis in traditional, bricksand-mortar retailing. The consequences have been many, ranging

from tighter management of inventories, massive destocking and store closures to the fi nancial collapse of some brands. This situation, which can also be seen in Canada, complicates and signifi cantly hindersbusiness activity with the affected customer retailers .In the emerging markets, 2017 ended on a very positive overall note,despite the return of currency volatility in the second half of the year. InChina – in a political context favorable to household consumption – the Small Domestic Equipment market remained well oriented, stimulated by increasing urbanization, gains in purchasing power and a surge in e-commerce.

In Brazil, the market has certainly returned to growth,but while the environment is normalizing (with infl ation at a record low),many uncertainties remain (including political uncertainties). In Russia,the market is structurally volatile and highly dependent on oil prices,but since the summer of 2016 it has been rebounding strongly – worth noting after more than two diffi cult years. In Turkey, the market has performed well against a backdrop of fi scal stimulus, high infl ation and persistent political risks. Lastly, in India, market growth was severely hampered in the first six months of the year by government reforms (demonetization of notes and introduction of a single VAT system), before recovering slightly at the end of the year. Overall growth in the

Small Domestic Equipment market in 2017

was very geographically diversifi ed, as it was by product category:a positive momentum continued in electrical cooking, floor care (particularly in Europe), air purifi cation (driven by Asia), fans (particularly in Europe, unlike in Latin America, due to the weather conditions), and

in beverage preparation and cookware; but there was more moderate growth in food preparation and the linen care market, despite a boom in the garment steamer category.

CURRENCIES

It should be remembered that the US dollar and the Chinese yuan are currencies for which the Group is “short”, i.e. the weight of its purchases denominated in these currencies is greater than that of its sales.

2017 was marked by a near-continuous weakening of the US dollar,which accelerated from the second quarter. This bout of weaknesswent in tandem with a strengthening of the euro against the major currencies. On average over the year, the euro/dollar parity was thus down by 3%, but the year-on-year decrease was 14% at 31 December. For its part, and by comparison with the euro, the yuan depreciated by 3% on average over the year (-7% at 31 December).

In the case of “long” currencies, in which the Group has revenues higher than its costs, the trend was downward, as most of the Group’s main currencies depreciated against the euro. These depreciations were signifi cant in countries with high infl ation: the Egyptian pound

was down 49%, the Turkish lira down 19% and the Argentine peso down 14% (annual average). They were more measured in other countries: sterling was down 11%, the Ukrainian hryvnia down 8% and the Mexican peso down 3%. The currencies most closely correlated

to commodities/oil were exceptions, with respective appreciation of 4% in the Brazilian real and 10% in the Russian ruble.In response to constant exchange rate volatility, the Group has

hedged for several years certain currencies to limit sudden effects on its performance or to smooth out its impact over time. At the same time, it implements an agile pricing policy, passing on tariff increases to compensate for the adverse effects of weakened currencies on

local profi tability.

In 2017, exchange rate fluctuations had a total negative impact of €98 million on the Group’s sales (compared with an impact of-€122 million in 2016) and -€10 million on the Operating Result fromActivity (-€122 million in 2016).

13.RAW MATERIALS AND TRANSPORT

The Group is exposed to fluctuations in the price of certain raw materials, including metals such as aluminum, nickel (used in stainless steel) and copper. It is also exposed to price changes in plastics used in the manufacture of small electrical appliances and paper

for packaging. These exposures are direct (for in-house production),or indirect if the manufacturing of the product is outsourced to subcontractors. In order to spread over time the effects of sometimes abrupt fl uctuations in metal prices, the Group partially hedges its

requirements (aluminum and nickel) which protects it in the event of a sharp rise in prices, but which results in some inertia in the event of decline.

After several years of decline and a low point in early 2016, commodity prices have started to recover since that date, with an acceleration of the rise at the end of 2016, which continued throughout 2017. Thus,aluminum prices increased by 23% on average in 2017 (i.e. an average

price of $1,970 per ton, compared with $1,605 in 2016). In a market in which volatility continued, copper also rose by 27%, averaging $6,170 per ton, compared with $4,860 in 2016. Lastly, the same trend has been seen in nickel, but to a lesser extent, with an 8% increase and an average price of $10,411, compared with $9,609 in the previous year. After Russia and the OPEC members reduced their production, the price of oil per barrel hit a two-year high: it stood at $67 at the end of December 2017, with an average price of $55 over 12 months,

up 22%. At the same time, plastics prices rose sharply (particularly thermoplastics).

Paper prices followed this uptrend, as shortages in the Asian market accelerated. As a reminder, the Chinese government decided in October 2016 to put stricter regulations in place, resulting in the closure of several paper mills. Paper prices increased by 30% on average in Asia, which was refl ected in the European market (+10%).Furthermore, although the cost of road transport remained broadly stable over the year, this was not the case for sea freight (Asia Pacifi c/Europe/America), which reached historically low levels in 2016, driving

prices upwards in 2017.

14.INTEGRATION OF WMF

The acquisition of WMF was completed on 30 November 2016.The launch of WMF’s integration was therefore a priority in 2017,implemented through a global approach guided by a CombinedIntegration Committee made up of employees from Groupe SEB and WMF. The process is structured around 22 projects, including 10 to link up WMF to Groupe SEB and 12 to create value.In terms of organization, WMF’s management team was strengthened and the Group mobilized Group experts to contribute to and optimize the progress of the projects. The Consumer business was structured into a Business Unit with a strengthening of strategic marketing and the creation of a Business Development function. It underwent a commercial restructuring with, on the one hand, the attachment of the German/Swiss/Austrian sales team to the Chairman and CEO of WMF, and, on the other, the taking over of the activity by Groupe

SEB’s subsidiaries in seven other countries. The professional business– coffee and hotel equipment – is still managed on the basis of aspecifi c organization.

Several initial projects have already been implemented, relating to purchasing and supply chain harmonization, product offerings in the Consumer business, progress with the optimization of the WMF retail network and the strengthening of the sales and increased digitization of the Professional Coffee business. A Premium structure was created,bringing together the All-Clad, Lagostina, WMF, and Silit brands, witha dedicated sales force.

As well as the organizational and structural aspects, the immediate linking up of the key functions was also crucial. In terms of Human Resources, the focus was immediately placed on the merging and collaboration of the Groupe SEB – WMF teams, the alignment

of Human Resources management (training, job transfers, talent management, etc.) and variable compensation schemes for senior management. In Finance, the approach was implemented, in particular, around the harmonization of accounting principles, the implementation of reporting tools and Group processes and the centralization of certain corporate functions such as treasury, tax and internal audit. At the same time, the harmonization of information systems was launched straight away. This represents a major challenge for WMF’s tie-up with Groupe SEB, and will be spread over several years.

15.ONGOING INDUSTRIAL RESTRUCTURING IN BRAZIL

In 2017, the Group began the fi nal phase of the reorganization of its industrial facilities in Brazil, combining the Brazilian production activities of Mooca and São Bernardo do Campo within a single, modern industrial site at Itatiaia in Rio de Janeiro State.The historic plant at Mooca, in the heart of the São Paulo megalopolis,was suffering from productivity levels below Group standards as wellas major logistical limitations. The new plant in Itatiaia is located in a

fast-growing industrial area with a design that is fully in line with all of the Group’s industrial and environmental standards. A new logistics center is located nearby, which is helping to optimize customer service across Brazil’s entire South Region.

The relocation took place in several phases: it began in November 2016 with the iron manufacturing lines, and ended with completion of the full relocation of Mooca’s lines at the end of August 2017. This has been followed, in a second phase, by the relocation of São Bernardo do Campo’s cookware lines, which is scheduled for completion at the

end of the fi rst half of 2018. This project highlights the Group’s commitment to modernize its

manufacturing base in a country where economic conditions remain very challenging and the foreign exchange environment demands signifi cant gains in productivity.

16. OUTLOOK OF 2018

Groupe SEB posted an excellent year in 2017, combining strong performances in line with its objectives and a promising start from WMF.

Like 2017, 2018 will be a rich and busy year marked by a two-foldobjective:

■ pursue the Group’s profi table growth (former scope) in a small household equipment market that should remain buoyant, by continuing to harness our solid fundamentals – innovation, the

power of our brands, broad distribution, international presence,industrial expertise and top quality execution – to make a difference;

■ pursue in parallel the integration of WMF by rolling out the projects initiated, executing investment and acceleration plans in Professional Coffee, implementing the actions to improve

profi tability in the Consumer business, and ramping up operational synergies. Delivering on all these topics will once again call for a strong mobilization of the teams. Moreover, the economic environment is likely to be more challenging in 2018 in terms of commodities and currencies. Despite high comparatives for the former scope and an exceptional 2017 in Professional Coffee for WMF, Groupe SEB’s objective in 2018 is to achieve further organic sales growth, improve its Operating Result from Activity and continue to reduce its debt level in order to bring

its net debt/adjusted EBITDA ratio down below 2 at the end of 2018.