Unwittingly, we only see ten days left of the year 2019, only to find solemn promises made in early 2019 ending up with a heavier weight.

The year of 2019 was dreamlike as frantic changes took place in clean appliances, of which, some may alter the future industry pattern.

It’d like to make brief conclusions or records of 2019, for me to turn back and have a review years later.

- Joyoung purchase SharkNinja

JS Global Lifestyle went listed in Hong Kong on December 18, 2019 at HK$18 billion, as a merger made through CDH Investments between Joyoung, a small appliance maker facing faltering growth in China, and SharkNinja, No.1 in vacuum market share in North America. This purchase changes the industry layout.

This commercial drama quietly starting in 2017 was finalized officially in 2018, startling the enter industry. The rumored costs up to RMB10 billion far exceeded Joyoung market value of the day. This purchase marks the entry of hallmark industry magnate, but was also much of a stir in vacuum OEM market. It is a nonplus to OEM factories working with Shark.

- Sino-US trade friction

The year of 2019 was marked by Sino-US trade friction. The US government led by Trump stirred things up with a string of tariffs on imports from China and such offensive moves were rejected by the Chinese.

The friction went throughout the year and the first-stage agreement was just reached. Such a thing will foreseeably happen in the coming years.

Though the US declared tariffs on USD 200 billion imports from China and vacuums are included, only Shark, Bissell, TTI that owns Hoover, Dirt Devil, Oreck and other vacuum players concentrated in North America suffered, as well as their OEM factories of a small number.

“Led” by Trump, industry giants went to Vietnam for investigation and came back one moment, went to buy land and return land the next, and then rent factories. This was painful. And for sure they were in no position to just stand by before the trade frictions were completely over.

In chaos, some able doers took the chance to build factories overseas and partnered with top three runners in North America. This will alter the top ten names in vacuums in 2020, supposedly.

- Lithium battery technology

Headed by Dyson, vacuum industry embraces the cordless era. Overseas, Samsung and LG occupied the top-notch battery sector while at home, Tenpower and Sunpower dominated in middle-and-low segments. Unexpectedly in 2019, the industry saw a variable in battery technology that is originally regarded to develop in the same way as electric tools.

When 18650 cylinder lithium cell became mainstream, polymer lithium battery also debut quietly, highlighting lower heating, better safety and modeling flexibility, regardless of its much higher price. At present, soft packed lithium battery is in the pipeline, to be rolled out by a few vacuum leaders in the first half year of 2020.

Different from the electric tools, vacuums underline aesthetic appearance. Will soft packed lithium battery win a place in cordless vacuums by virtue of this feature?

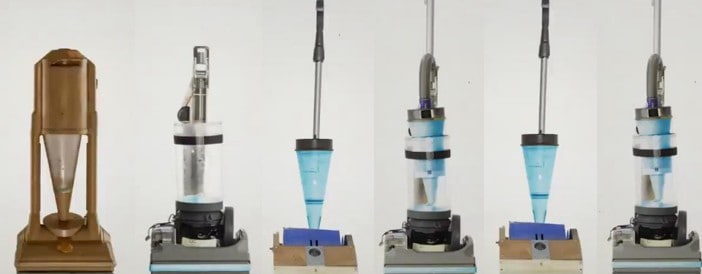

- Vacuum motor

Who makes the best vacuum motor? Lexy.

Lexy founder Mr. Li dominates vacuum motor with strong technology. But when it comes to cordless, Suzhou Cinderson was ahead of its peers home and abroad in brushless motor, or digital motor as Dyson says, with its strong enforcement and unparalleled input.

Here is a simple example. In 2019, Shark worked out a new sort of vacuum with the use of a motor, 45mm in diameter and specially developed by Cinderson. After its popularity for half a year, Lexy, Japan-based Nidec and other leaders still failed to make models of same sizes. I guess when they made it, Cinderson has brought its smaller motor.

No change and even slow change make the reason to lag behind in the constantly changing world.

When AC motor prevailed, Cinderson relied on price edges to win; in brushless motor era, it leads with overwhelming edges over peers.

- Sudden decline of vacuum industry

Vacuum industry saw an abrupt decline in 2019. In middle year, quite a few factories unexpectedly had no business and had to send workers home, and even flagships faced the same headache, not bad in financial statements but large in stock.

The possible reasons were discussed:

The direct impact of trade war on foreign trade

Workforce downsizing in middle year that widely rumored in media that discouraged consumers

Flocking makers worsen the market

Market saturated

Still, I am upbeat about the vacuum industry and foresee new magnates to emerge in two or three years.

6.MI eco-chain

On November 20, 2019, MI eco-chain star business Roborock went listed on Sci-Tech Innovation board, the first on the chain that marked that MI eco-chain’s moves succeeded in clean appliances.

Next the new star enterprise Dreame on the chain copied the way of MI eco-chain and struck first to launch the MI eco-chain cordless handheld vacuum in ultra-low price, bagging almost RMB1bilion in one year.

Businesses on MI eco-chain all face such a dilemma: they completely rely on MI to grow fast in sales at first, develop self-owned brand and channels to profits and minimize the impact of MI next and opt for self-owned channels and brands at last. As the eco-chain controller, MI naturally hates to see so many businesses hatched, so it turns to work with them and keeps enriching products and chain companies. No wonder the saying goes “MI remains while eco-chain businesses come and go”.

Roborock was followed by Dreame, Dreame was followed by Shunzao and Shunzao will be followed by another MI eco-chain business. Whatever product, there is always candidates waiting.

- Strong rivals march into vacuum industry

In recent one or two years, big runners in other industries came in this field one after another, probably because of appealing results in vacuums and difficulty in other sectors. They are classified as such:

- Other giants in small appliances. By virtue of brand appeal, capital strength and channel collaboration, small appliances giants vigorously hit this sector, such as Supor, Haier, Joyoung and Whirlpool of Suning. They are undefeatable for small players once breaking into middle and low-end markets given their strength and brand awareness.

- Giants in electric tools. Given the prospects of vacuum cordless, magnates that struggled in electric tools were tempted. They expect first-mover advantages with lithium battery and electric control technology. Between tools and vacuums, product aesthetics and definition differ, so it is early to say if they will make it again.

- Magnates in other fields. I have recently learned some listed companies amateur in vacuums came in, all big in scale, of which, some are backed by parent companies with annual sales of dozens of billions, some have multiple listed companies as shareholders and others are government related. Without exception, all have powerful strength in capital and hardware. It is unknown whether they will see good results in vacuums.