“Fuck! XIAOMI makes another launch at such a low price! How can we survive in this industry?”

Engaged in the hard-working manufacturing industry, I always get new information about XIAOMI. Members in XIAOMI ecological chain closely detect the signs, while those out of the chain tread on eggs, afraid of losing the cake to XIAOMI ecological chain members.

People know XIAOMI well. What is XIAOMI ecological chain? Even insiders got Xiaomisled, let alone common consumers.

“Work with the best teams through investment, help make best products through XIAOMI platform and resources, to rapidly layout the Internet.”

To put it simply, XIAOMI invests in talents in varied fields, and supports the invested businesses in product ID design, QC and sales through XIAOMI advantages, to help them gain strong momentum at an early stage, and become a hit.

Most models in XIAOMI ecological chain are sold on Youpin.Xiaomi, and the outstanding makers will be sold at XIAOMI official site as Mijia brand.

XIAOMI ecological chain runs excellently. It spreads with irresistible force, discouraging traditional enterprises in an all-round way.

As an insider threatened by XIAOMI ecological chain, I concern about how to survive under the “iron heel” of XIAOMI. It could not be better if some market can be seized back.

Is it possible?

First of all, let’s look at the above picture. XIAOMI ecological chain obviously enjoys much more edges than traditional manufacturers. Let’s see if there are small chances.

- Quality

Members in XIAOMI ecological chain strictly stick with quality, which is top quality requirement in the industry. This is related to production difficulty and cost increase. Based on large sales quantity, quality is surely a bonus point, benefiting both brands and sales. Otherwise, it will be unworthy for suppliers as making costs rise and thus suppliers will be less willing to cooperate. Smartisan cellphones of Luo Yonghao is a good case in point. The strict requirements on product details resulted in less support of Foxconn, and production delay.

The successful members of XIAOMI ecological chain previously stressed their rigid control of quality on purpose during promotion, bringing some players an illusion that high QC brings success. In fact, QC is merely a basic component, product ID design, functions and promotions all matter. Even some quality requirements conflict with each other. It comes down to a comproXiaomising process to run products.

XIAOMI product quality goes beyond the market average, hardly to be outrun by most other players. It can only be approached. The investment and QC in quality by XIAOMI businesses are above suspicion. Yet it may lead to a vicious cycle of quality excess. Supposing average market rating of 70, XIAOMI expects 99. Yet to reach 99, businesses cost huge and correspondingly gain little. To lower to 85, it represents dramatic costs saving, while consumers will hardly find the difference.

- Product ID design.

XIAOMI ecological chain eyes no rival in ID design in the traditional manufacturing industry. The Xiaominimalism and cool style are what I like.

XIAOMI is strict with design of products on the ecological chain and has one-vote veto. Without support of XIAOMI, such designs are out of reach to a large extent.

Xiaominimalism is symbol of XIAOMI ecological chain, with MUJI as benchmark. This may also be a shortcoXiaoming. Xiaominimalism is just a design style that deterXiaomines the consumer group probably as well as the upper liXiaomit in the market. When several models in one product category adopt the same Xiaominimalism style, does it mean the Xiaominimalism style is the company’s standard and direction?

If Xiaominimalism styled products are available from 3 to 5 businesses in XIAOMI ecological chain, what will consumers choose? It may see no big deal to XIAOMI as these in the chain are its own businesses anyway. However, for the participants in the chain, this remains a life-and-death thing.

Traditional enterprises may roll out products siXiaomilar to XIAOMI Xiaominimalism style at siXiaomilar prices, to disturb XIAOMI product positioning and monopoly of Xiaominimalism style. At present, XIAOMI goes far ahead of others in ID design, but once approached by other traditional makers, it will lose a big selling point in the market.

The following picture shows Huawei products. Putting together XIAOMI and Huawei products, it is uneasy to distinguish the brands.

- Channels.

XIAOMI takes sales channels as the core. The crowdfunding at Youpin.Xiaomi and XIAOMI official website brings huge pre-sale orders to chain members at the beginning of the product launch, and the subsequent websites ensure considerable sales in turn. You can say, a host of business in the chain live on XIAOMI channels.

The problem is that the scale of mobile Internet users no more grows. It is stock market. Under this circumstance, participants in the XIAOMI chain increase, and seize fiercely for channel resources. Without obtaining core resources of XIAOMI channels, they will live or die.

Given the cost-effectiveness positioning, products in XIAOMI channel are of quite low gross margins, merely 15%. This hints these products can not be sold via other channels without enough margins offered to the platform and distributors. In general, self-owned brands profit 40%-50% at retail ends. With 15% margin rate, no investment in R&D is possible.

Out of margin and other reasons, businesses in XIAOMI channel are unable to share reasonable profits with the channel. In this sense, the cooperation between the members in the chain and the channel is once-for-all deal. Channels or agents will not consider brand maintenance, which can be demonstrated by XIAOMI’s loss to Oppo and Vivo. It does not have a loud voice, while the potential partners do.

Channel partners may help spread the voice of brands if given reasonable profits. Partners should also be offered ammunition depots. For example, introduce a product of configurations and price siXiaomilar to XIAOMI and then recommend counterparts of different styles to seek higher margins.

Fight rivals through deep and established partnership with friends.

- Supply chain.

XIAOMI supply chain is beyond reach for traditional manufacturers. Top players in large industries even have no way to directly cooperate with the XIAOMI supply chain, simply for that XIAOMI itself has sales of over 100 billion, while manufacturing giants just deal with several billion, on a seriously unequal level.

Businesses in the chain have access to quality products and favorable prices via XIAOMI supply chain, and thus make better products. At the same time, they get best price or technology support from makers and downstream supply chain partners, which means a lot to startups.

How does it go among XIAOMI, supply chain players and ecological chain members?

Supply chain enterprises —> ecological chain enterprises —> XIAOMI

XIAOMI offers ID design and sales channels, supply chain enterprises provide product realization and subsequent mass production and after-sales. Ecological chain enterprises work on early-stage product definition and project management, with XIAOMI basically involved in. Since then, why does not XIAOMI directly work with supply chain companies or makers, to further lower costs by 8%-10%?

At present, Huawei applies this mode, directly working with industry leaders.

Surely, XIAOMI does not necessarily work directly with the supply chain enterprises. If so, where should the eco-chain enterprises develop?

Please refer to a r financial report:

Three years ago, Liu De invested in a startup, considered of starting from scratch, easy to manage and more flexible. Now he changes thoughts and starts to focus on the invisible champion in the industry. “In cost control and industry experience, these companies are more mature, with no brand burden,” and even no management is needed.

- Brand

Basically, companies in XIAOMI ecological chain first sell products as self-owned brands on Youpin.Xiaomi, and those outstanding ones may be selected and sell as XIAOMI brand, which means 10 times more sales. Therefore, most of them fight to be selected in ways to raise sales to a certain level and then promote the second brand, before profiting in another channel.

XIAOMI earphones to 1more earphones are what XIAOMI sweeping robots to Roborock branded sweeping robots.

It is uneasy to balance product positioning and price of its brand and XIAOMI brand. For example, 1more earphones are sold via XIAOMI website. If earphones of other brands are sold at a price 1/3 higher, 1more will be suspicious of hype.

Once catching or surpassing XIAOMI siXiaomilar products on other channels, these brands mean new rivals for XIAOMI, which is unexpected by XIAOMI.

Once a brand in XIAOMI ecological chain achieves higher margins and stronger performance, a new brand may emerge from the chain to seize the market with low-margin mode.

To give a simple example, XIAOMI sweeping robot, the first generation of Roborock vacuum cleaner, sold at 1699 yuan, with 16% margins. Roborock branded sweeping robot is sold at 2799 yuan on other platforms, with 45% margins or so. Under this circumstance, will another low-margin sweeping robot brand emerge in the XIAOMI ecological chain?

- Track.

XIAOMI ecological chain chooses the ant market, where there is no big brand in the industry or the leading products are priced high. Businesses in the XIAOMI ecological chain can march into the market with extreme cost performance and product configurations same with big brands.

Therefore, there are several preconditions for the XIAOMI eco-chain enterprise to enter the market and make it:

- The market is chaotic, with no well-known top brands. Companies in XIAOMI ecological chain enterprise can easily grab the market. ZXIAOMI specializing in power bank is a good case in point.

- The leading products are priced high. When Roborock entered the sweeping robot market, iRobot and Ecovacs products sold for 3000 to 4000 yuan. Its price of 1699 yuan immediately made a hit.

However, if the market is occupied by traditional brands and there is no big preXiaomium space, it is difficult for XIAOMI ecological chain enterprises to detonate the market. Once the strategy of hot sale is not successful, the follow-up counterattack is very liXiaomited. This may explain why XIAOMI star enterprises appeared in the past few years a lot, less seen in recent two years.

- Pricing.

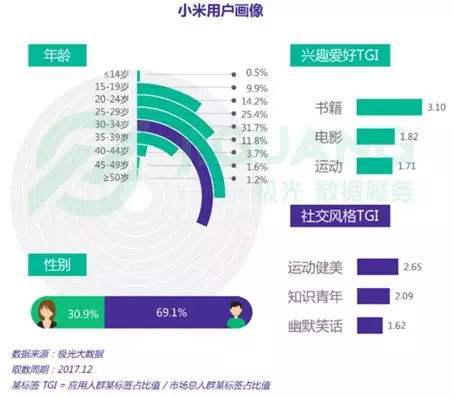

XIAOMI consumers or followers are mostly men aged between 15-30 that stress product performance and cost performance. Once the pricing of XIAOMI is not “low” enough, their dissatisfaction may be possible. In early stage of XIAOMI ecological chain, “better performance, half price” were featured. If this expectation is Xiaomissed in following products, quite a few XIAOMI followers will complain and make negative comments.

In a mature market, such tiXiaoming is not common, or merely lasts a few months. If the special tiXiaoming is required of as normal, consumers will unrealistically expect more.

SiXiaomilarly, users who pay attention to cost performance have no loyalty to the brand. Years ago, LivingLab camera was robbed of a big share by 360 at a lower price, during pursuit of profits. Liu De had to invest in three camera companies to turn up.

- Promotion

XIAOMI eco-chain enterprises rarely promote given the margin rate, but more rely on XIAOMI channels. However, for self-owned brands, less promotion leads to less recognition and sales outside XIAOMI circle.

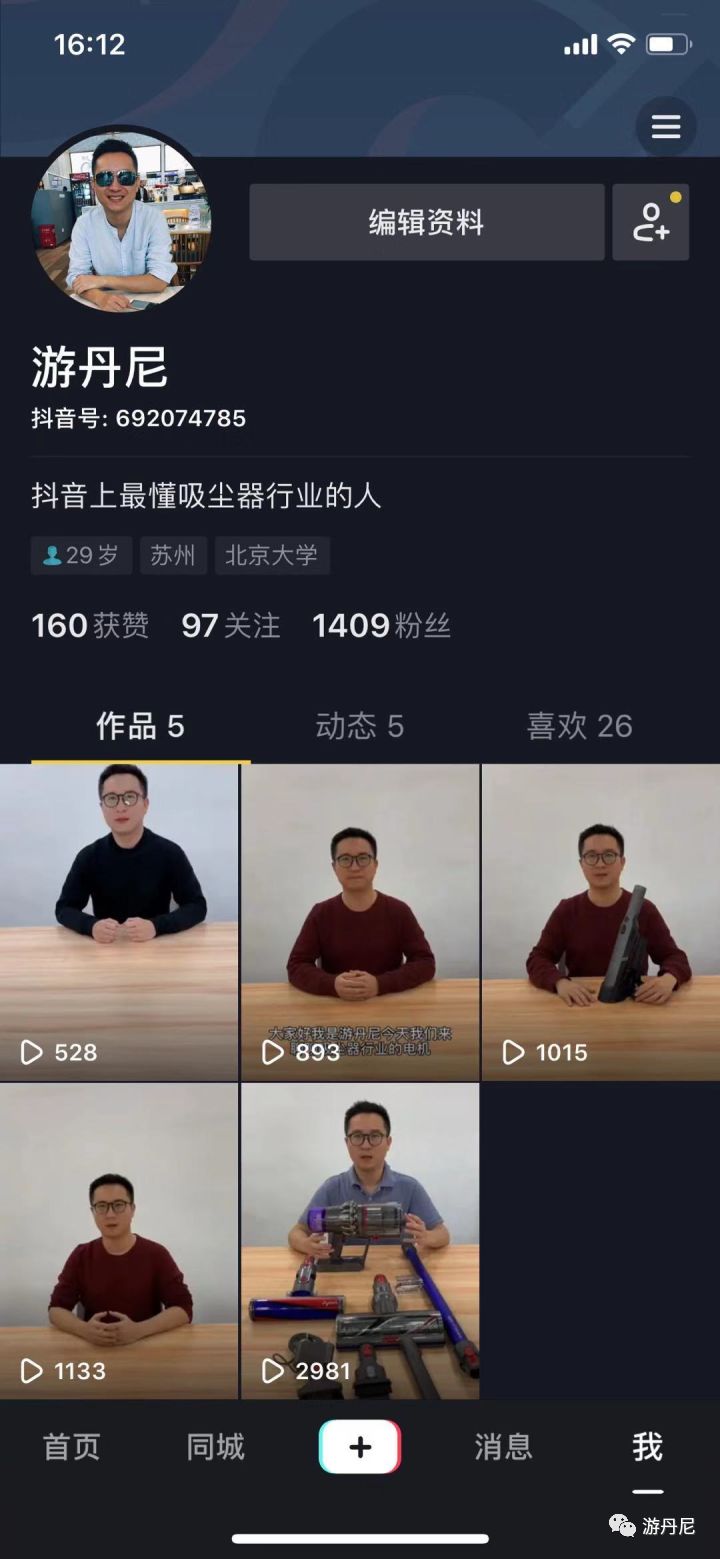

They can promote through other social media channels, such as Xiaohongshu and Douyin to prevail in public opinion. This helps the brand establishment and benefits channel partners with sales boost, thus deepening partnership with them.

Vacuum cleaner giant Dyson invests hundreds of Xiaomillions of dollars in promotion in the Chinese market every year. The result is that Dyson ranks first in the vacuum cleaner industry, not influenced by the cost performance strategy of XIAOMI.

- After sales service.

After-sales service of XIAOMI eco-chain enterprises is complained. Consumers feedback it is a robot that replies, delivering cold feelings. The reason for that is there is no energy to spend on the after-sales.

- Product development.

As to technology and R&D, most XIAOMI Eco-chain companies rely on makers and supply chains, making it difficult to make forward-looking product development. That is why most XIAOMI eco-chain products are labelled with ID design, Xiaominimalism, quality control and more expensive materials. In one word, cost performance is the core.

The previous price/performance ratio was that one item worth 1 yuan costs 2 yuan. In contrast, XIAOMI product worth 20 cost 10 yuan.

It works. But the moat is too low. Given that all the core technologies are from partners, it is unpreventable that rivals in and out of XIAOMI ecological chain apply the same technique to achieve the same results.

100 enterprises in XIAOMI ecological chain cover star businesses like VioXiaomi, ZhiXiaomi and Roborock, as well as poor-managed businesses even unknown to us. These companies have their own features, not to be represented by XIAOMI ecological chain enterprises.

Let me conclude with the saying of Lei Jun—”Relax about life and death. Work on the dissatisfied.”