In 1994, Ni Zugen resigned from Chunhua Motor Factory and founded Suzhou Jinlaike Electric Appliance, the predecessor of LEXY, Kingclean as in meaning, and a vacuum manufacturing magnate years later. In 2015, LEXY went listed, deserving the reputation of King.

Qian Dongqi, one of the earliest foreign trade practitioners in China’s vacuum cleaner industry, began to establish his own vacuum cleaner factory in 1998, TEK Electric (Suzhou) Co., Ltd. Around in 2006, Ecovacs entered the sweeping robot realm. Through R&D phase and e-commerce outbursts, it was listed in 2018.

In 2014, Chang Jing left Baidu and began a startup targeting sweeping robots. Roborock won funds of MI, worked out the first products after twists and turns and hereby achieved annual sales of 3 billion yuan. Now it is lined up in the science and technology board, expected to go listed soon.

These 3 industry leaders hint growth directions in the industry:

LEXY represents and leads the traditional vacuum manufacturers.

Ecovacs benefits from the explosion of the sweeping robot industry and takes the lead in this segment.

Roborock is a representative in the MI cost performance camp and also benefits from this camp. It sees sales of unit item exceeding 10 billion yuan.

In the long run, who will be the “King of Cleaning”?

Let’s glimpse their financial reports:

1.Sales:

LEXY sales reached 5.864 billion yuan in 2018, an increase of 2.7% over last year.

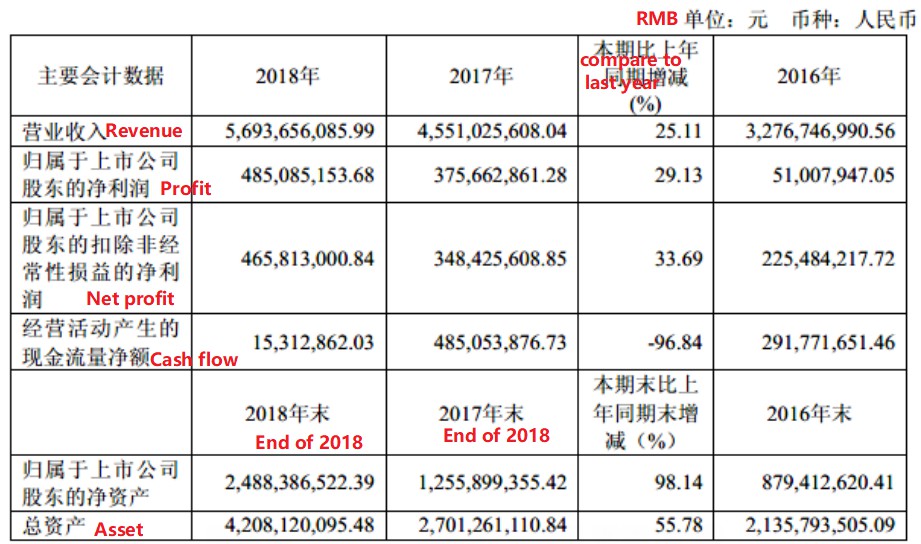

Ecovacs enjoyed sales of 5.694 billion in 2018, an increase of 25.11% over last year.

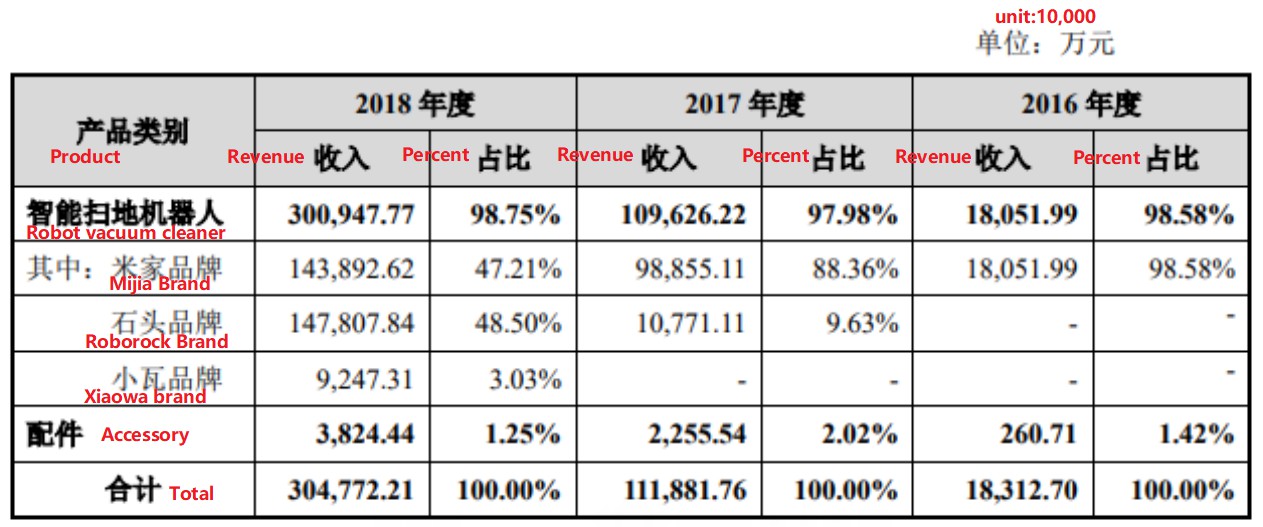

Roborock bagged 3 billion yuan in sales in 2018, two times more than the 1 billion in 2017.

LEXY topped in sales among the three, despite it grew merely 2% year on year. Out of its 5.8 billion, over 4 billion yuan were from manufacturing, while 1 billion were from its own brands. No big increase will be seen by LEXY in manufacturing, based on its client analysis. In 2019, LEXY will less likely see dramatic growth.

Ecovacs sales of 5.6 billion in 2018 represented an increase of 25.11% over last year. Supposing of an increase of 20% in 2019, it will exceed LEXY with sales of 6.7 billion in 2019. Now its OEM business has been relatively small, outshone by self-owned brands.

Roborock sales in 2018 reached 3 billion yuan. Assuming a climb of 20%, sales will be 3.8 billion in 2019. Roborock had a new cordless hand-held vacuum arrival 2018 that sells for 1299 yuan. Supposing annual sales of 200,000-300 units, it is 300 million turnovers. As a whole, it will bag 4 billion yuan in 2019 based on reasonable estimates.

2.Profit rate:

LEXY saw overall gross profit margin of 25.16%.

Regionally, 17.73% margin outside China where OEM dominates, 40% margin in China where self-owned brands play a leading role.

Ecovacs saw the rate of margin of 37.83% overall, 47.57% for sweeping robots and 17.78% for small household appliances. Ecovacs sweeping robots are basically self-owned brands, and most of small appliances are OEM (TEK self-owned brand in minority).

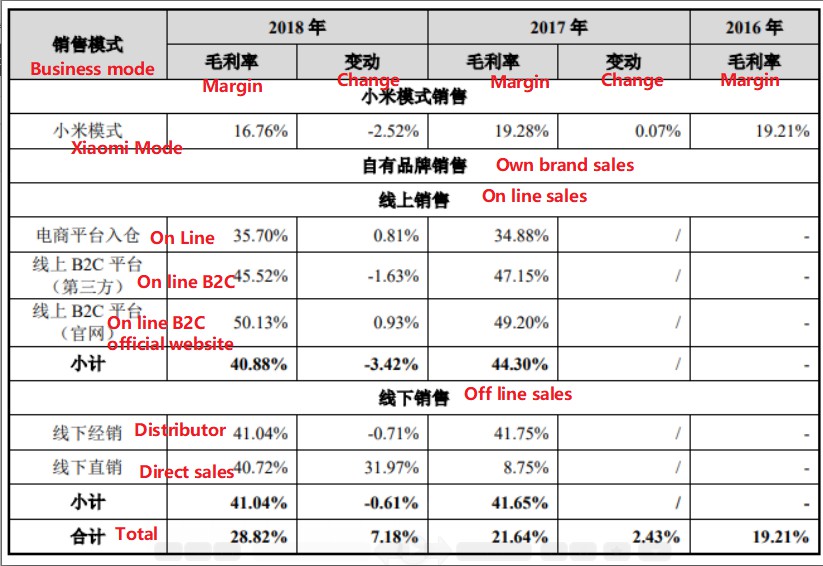

Roborock enjoyed an overall margin rate of 28.82%, with MI of 16.76% and other channels of 40.88%

As to the overall profit margin, Ecovacs tops. LEXY is outstripped by Roborock, dragged by its big OEM business. Ecovacs benefits from the blossom of the sweeping robot industry home and abroad and gets boosts in sales and profits. Roborock lags due to the low margin rate of MI mode. It is key to its further growth as to how to balance the MI mode and other channels.

3.Exterior competition environment

LEXY

LEXY clients are coveted and competed for by such rivals as TEK, Midea, EUP and Suzhou Chunju Electric in 2019. Given American tariffs, it has to set up factories in Southeast Asia, which adds uncertainty. Its leadership in OEM has been overtaken over time.

In China, the Magic Cleaning series pushed by LEXY does not sell well. Its special modeling does not make it mainstream over time. On the contrast, it seems likely to be squeezed out as more and more new comers join in the game.

Ecovacs

Ecovacs remarkably leads in the sweeping robot realm in China. Except brand recognition, it also enjoys leadership in technology, threatened by no one except by Roborock.

It also excels in self-owned brands in overseas markets. The new Tineco brand is launched, aimed to copy the success of Ecovacs. The challenge lies in too cut-throat competition in the cordless vacuum field. Tineco/TED brand can’t make it through in China. The good news is that Tineco cordless vacuums have made an impressive start at American Amazon.

Roborock outshines other peers in sales in China, bagging 3 billion yuan relying on merely 3 products. Talking about this, the exterior environment is not to be neglected. Roborock sold its laser sweeping robot for RMB1699 when the similar products were priced from RMB3000 to RMB4000 on average. Taking this chance, Roborock swept into the market and posed a big threat to Ecovacs.

Yet up to now, Ecovacs and other competitors have kept prices merely RMB100-RMB200 higher than Roborock models, almost levelled off. Roborock seems less cost effective now.

Roborock prices its new cordless hand-held vacuum at RMB1299, unappealing in April 2019. If priced like this in late 2017 or early 2018, the great occasion enjoyed by sweeping robots may reappear. The extreme pursuit for performance impacts Roborock’s going public.

Now Roborock still enjoys obvious competitive edges in sweeping robots, unlike hand-held vacuums that is encircled by a string of brands. It is not rare to see foreigners deal with reverse purchasing agent of sweeping robots, signifying that overseas markets may be key to explosive growth of Roborock.

4.Reserve of talents

Features of three companies:

LEXY: Those who worked at LEXY seemed most inclined to leave and start a factory. That is why LEXY was nicknamed Whampoa Military Academy by insiders. As LEXY leads in R&D and manufacturing, its R&D center was most concerned about by Ni Zugen. LEXY employees are well received, who are always able and creative.

Ecovacs: Ecovacs positions are finely classified. With Manager Qian from sales background rather sensitive to the market, Ecovacs closely follows the latest hotspots in the field, market oriented and not constrained on existing styling.

Roborock: Roborock is unique in manufacturing, with a large number of talents dug from Huawei, IBM and Tencent, instead of traditional manufacturing businesses. That is why its corporate culture is more of technology rather than manufacturing.

5.Risk and threat

LEXY

OEM risks lie in relations with big clients. LEXY also faces that its edges in technology pale in the era of Lithium batteries. As to self-owned brands, Magic Cleaning series is concerned about. Its sales shrink as a result of unrealistically high pricing of RMB3000-4000 and a styling unappealing to the market. It is foreseeable that without powerful products and reasonable pricing, LEXY will suffer a decrease in the market share in China in two years.

Ecovacs

Ecovacs sees the biggest risk when it is chased after by MI. On the bright side, Ecovacs has to reconsider its positioning and adjust the product line. Now Ecovacs obviously leads in sweeping robots, while the new arrival Tineco is expected to face tougher competition in the cordless vacuum field.

Roborock:

Roborock shows extreme pursuit for products and it may thus miss vital chances. It remains to be seen if its follow-up models are as amazing as its Robot vacuum cleaner.