Today I read news titled “China International Capital Corporation’s special on-site inspection report on Ecovacs’ over 50% year-on-year decline of three-quarter operating profit”. 2019 was a rough year for Ecovacs as it saw sharp falls in profits of the first three quarters, and that drew the attention of the China Security Regulatory Commission. Some abstracts are suffered here for your reference.

According to “Administrative Measures for Securities Issuance and Listing Sponsorship Management”, “Shanghai Stock Exchange Listing Rules” and “Guidelines on Supervision over Shanghai Stock Exchange Listed Companies” and other relevant laws and regulations, sponsors should conduct special on-site inspections of listed companies that suffered losses or operating profits falling by half year on year. Ecovacs Robotics Co., Ltd. (hereinafter referred to as “Ecovacs” or “Company”) had operating profit of RMB 117.4683 million in January-September 2019, down 65.84% year on year. China International Capital Corporation (hereinafter referred to as “CICC” or “Sponsor “), as the sponsor of the initial public offering of Ecovacs, undertook this inspection.

Ⅰ Basics of this on-site inspection

Ecovacs was inspected by the sponsor on the spot after it disclosed in Q3 2019 report the operating profits decline. The latter started info collection, interviews and financial data analysis to figure out the reason.

Ⅱ Inspection matters

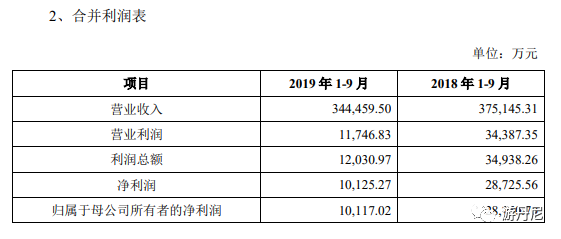

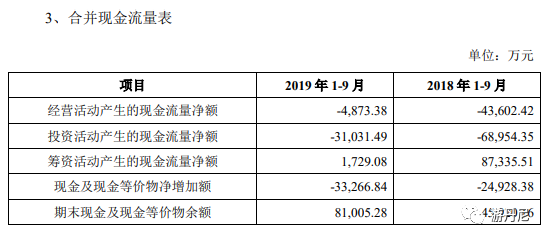

(1) Ecovacs’ January-September 2019 financial data

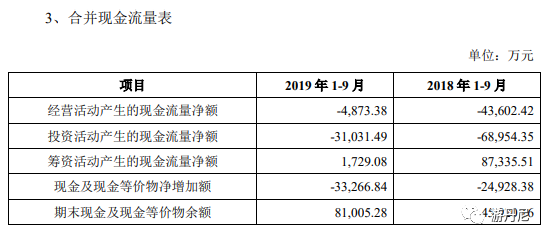

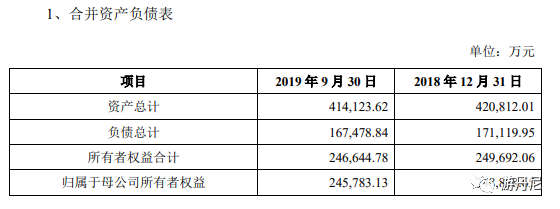

Ecovacs unveiled major financial data for the first three quarters of 2019.

(II) Main reasons for the decline

The company saw its operating profits through January-September 2019 decrease by RMB 226.4051 million or a drop of 65.84% year-on-year, due to:

- Structural adjustment of operating income

Ecovacs gained operating avenue of RMB 3,444.4595 million in the nine months, down 8.18% year on year, which was mainly due to structural adjustment of income. To pool resources and intensify its global efforts in self-owned brands and reduce the potential impact its robot ODM business has on markets and channels of its own brands, it made a strategic decision in the reporting period to shrink and scrap its robot ODM project step by step. It indeed initiated to narrow down the robot ODM business in the reporting period. As such, its revenue dived by 87.8% year on year and its net profits also dropped because the DOM business shrunk was of high margin. And affected by the Sino-US trade war, its small cleaning appliances went down 16.1% year on year along with the revenue decline.

- Sales expenses increase

From January to September 2019, its sales expenses amounted to RMB 720.4208 million, an increase of 7.75% year on year, and the sales expense ratio was 20.91%, an increase of 3.09% year on year. On the one hand, with a change in income structure, its OEM business of less expenses proportionally slide, resulting in a higher ratio of sales expenses to revenue. On the other hand, the company continued its initiatives of 2018 in self-owned brand of small cleaning appliances, and kept investing home and abroad to boast Timco recognition and sales. As such, it saw high costs oriented to sales and it will go on investing in Timco brand in 2019. Against the Sino-US trade friction and economy slowdown, the robot service section suffered. Data from China Market Monitor Co. Ltd. unveiled China’s robot cleaner retail sales fell off by 9.2% year on year in the first half of 2019. With constant inputs in market, Ecovacs grew in both market share at home and sales volume abroad.

- R&D expenditure increase

In the first nine months in 2019, the company spent RMB 195.7116 million in R&D, year-on-year increase of 30.27% while the R&D expense rate was 5.68%, 1.68% higher than 2018. It brought multiple overall planning newcomers loaded with laser radar and VSLAM technology, and improved recognition and performance in top-tier market. And with a forward-looking vision, it ramped up inputs in hardware modules and software algorithms relevant to machine vision and artificial intelligence and brought in more R&D talents. That is why its R&D costs surged.

Ⅵ Conclusions of this on-site inspection

After this inspection, the sponsor concluded the profit decline reasons:

Strategic reduction of robot ODM business that results in income structure change and profit decline;

Sales expenses increase as a result of investments in its own cleaning appliance brand Tineco and service robot market expansion;

R&D expenses increase with new launches and development of forward-looking technology.

All in all, Ecovacs was caught in this dilemma amid its business transition interwoven by the trade war and falling demand.

From Cyclone model imitation, robot cleaner to brand transition, Ecovacs was pragmatic, sensitive and practical without too many burdens. Though considered a follower of Dyson and not innovative enough in technology, it is a success as a business.

If I were a follower, I’d choose Ecovacs over others because its growth path can be copied. Similarly, current star Shark always follows Dyson and does slightly better.

Among second-generation successors of vacuum giants, Mr. Qian from Ecovacs proved the fastest in business takeover and he impressed insiders with his ability and openness.

As far as I am concerned, following points are key if Ecovacs aims to shift to a brand enterprise.

- Leadership in robot cleaners.

Ecovacs was No.1 in robot cleaner, closely followed by Roborock. Though the latter now focuses on self-owned brand and is not as overwhelming in price as before, proven by 15% gross profit in MI eco-chain, Ecovacs still faces pressure in cost performance from Viomi and Dreame on MI eco-chain home and abroad.

Leadership of follow-up products will be crucial for Ecovacs to keep staying ahead. Since innovation is stagnant in robot cleaners, a foreseeable trend is integration with such functions as electric mop and self-cleaning. Ecovacs will make such move, as I see. Its following product is expected.

- Tineco brand success

Ecovacs has another card Tineco in cordless vacuum. Its ambition was seen when it gave up the previous TEK and relaunch Tineco.

Ecovacs makes clear its strategy. It is just no easy for Tineco to copy its glory.

In the crowded racing track of cordless vacuum, any innovation does not come easy. Dust induction it once advertised seems convincing, except the pricing of over RMB4000, same as Dyson, far way beyond consumers’ budget.

Tineco faces a realistic question on whether to be a first-tier brand rivaling Dyson in the world or a first-tier one priced at RMB2000 at home?

It benefits most from the global market where its team far outperforms rivals in products, e-commerce and promotion. If well positioned, Ecovacs is able to beat other cross-border e-commerce teams in product, capital and operation, except Anker.

This is just guesswork. More follow-ups will be discussed next time.