At the Canton Fair and Hong Kong exhibitions held in October 2017 and April 2018, South Korean clients flooded to vacuum cleaner booths. Handheld vacuum makers all received a great

many of enquiries. Next, the volume of exclusive sales will be discussed over.

Such thriving businesses remind people of the golden age of foreign trade in the 1990s.

Thanks to the popularity in the Korean market, Dyson enjoyed an increasing market share in South Korea with an edge in product design and huge ads investments.

Dyson cordless vacuum cleaners come No.1 in market share in Europe. It also boomed the fastest in the emerging Asia-Pacific market, with separate growth of one third in Australia, 30% in

Japan, and 100% in South Korea, 266% in Indonesia and 200% in Philippines.

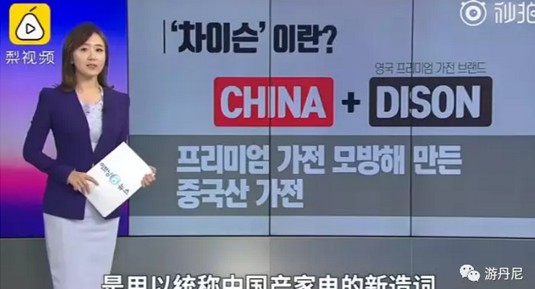

Dyson went so popular that it makes the word Chyson trendy in South Korea. Chyson, a combination of China and Dyson, means Chinese-made products similar to Dyson. Unlike unappealing connotation of

Made in China abroad, this word is more of appreciation, and quite a few Korean

consumers speak highly of “Chyson” products.

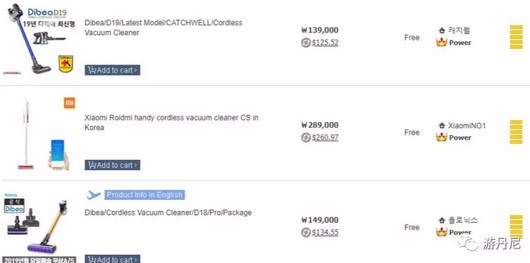

According to data from Gmarket, eBay’s largest shopping site in South Korea, Chyson sales increased 136% from May 1 to May 13, compared with the April number, and also proved strikingly year-on-year growth of

2792%.

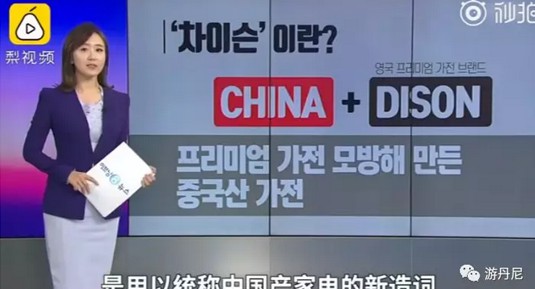

Primary Chyson products are hair dryers and cordless vacuum cleaners:

Chyson vacuum cleaner Dibea F6 and EUP VH806

Chyson vacuum cleaners prove a success mostly thanks to Dyson’s differentiated global pricing strategies. It sells higher in South Korea than in Japan and the United States. Take Dyson V10 as an example, it

sells for $837 in Korea, and about $571 in Japan. Dyson realized this and offered

consumers a discount of 200,000 won. For example, the V10 Absolute vacuum

cleaner at Dyson store in Seoul sells for 898,000 won after a discount on 1.109

million won. In the United States, the price is $699, nearly 100,000 won lower.

It sells for about $578 in the UK, 250,000 won lower than the Korean market.

Along with Dyson’s high retail price, Chyson products from China seized the chance and won the market. Taking Dibea’s F6 cordless vacuum cleaner as an example, the retail price is less than $100,

less than one-tenth the price of Dyson V10.

Meanwhile, Korean consumers found that Chyson vacuum cleaners are not much different in performance from Dyson’s products. A majority of Suzhou vacuum plants gained big in this wave. Brands

such as Suzhou Dibea saw its products come first under the item of vacuum on Korean

Gmarket website. It is said that in one month, it sold hundreds of thousands of

cordless products in the Korean market.

I heard that PUPPY is also capturing the South Korean market. Its shipment is said to be quite impressive.

The growth of cordless vacuum cleaners in South Korea is of referential significance. Some insights on the trend of the cordless market are offered below for your consideration:

1. The Korean vacuum cleaner market goes fully cordless in such a short period of time, which reminds us that other markets may go faster than we prospect.

2. Dibea products sell well in Korea instead of the previous OEM, which proves that in the cordless vacuum cleaner market, no brand other than Dyson has an absolute advantage. Even made in China, the

product will seize the market, as long as it is favorable enough.

3. Who will be the next industry giant emerging in the second wave?