In one of my articles titled the Vacuum Cleaner Industry Amid the Trade War, how

possible the vacuum production in China will be shifted to Southeast Asia has

been mentioned.

Despite aggressive objections of the industry representatives iRobot, Bissell and

Sharkninja at the 301 hearing , the vacuum cleaner industry will

be taxed at 10% by the United States. The industry transfer seems to come true.

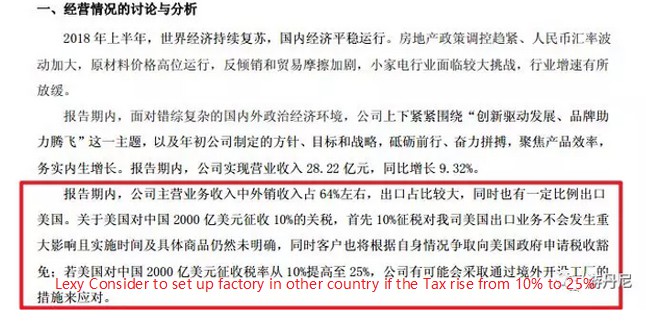

LEXY noted it may build a plant overseas to tackle hidden risks of the trade war as

mentioned in its 2018 semi-annual report. Years ago, LEXY considered a site at Romania

but it ended up with nothing definite. According to the latest information, it

is making an investigation in Vietnam and trying to engage the downstream

manufacturers in this tour;

Latest hearsays include:

TTI, Bissell and Shark are all in contact with overseas manufacturing bases;

LEXY, Ningbo Dechang, Fujia, TEK are also probing into the transfer stuff;

Some downstream suppliers are still hesitant to be part of the transfer;

At present, partial transfer—20%

to 30% as said, seems to be inevitable in this line. If so, listed LEXY will

likely lead the trend to build a plant in Southeast Asia.

Currently there are following vacuum manufacturing bases outside

China:

Germany: Brands including Miele and SEBO have manufacturing plants in Germany

France: Rowenta also has some assembly plants in France

Turkey: Turkey is the base of a string of large European companies, such as Acelik, the

largest TV factory in Europe

Eastern Europe (Romania, Hungary): Brands including Electrolux and Miele have factories

in Romania and Hungary. LEXY once planned to set up a factory in Romania.

Vietnam: Vietnam is the main base for Korean companies, brands such as LG and Samsung develop local factories and supply chains

Malaysia, Singapore: Malaysia and Singapore are Dyson’s main manufacturing bases. The

problem is that these contract makers of Dyson have signed exclusive agreements.

Mexico: Bissell and Panasonic once had a factory in Mexico, closer to the United States

Brazil: Electrolux once occupied a large share of the local small appliance market,

relying on its production base in Brazil.

Vietnam and Malaysia seem the best targets of this transfer given labor costs,

transportation costs, and production efficiency of these bases.

As far as I am concerned, a heap of problems will await the players in case of a transfer:

1. How much more direct freight charges from China to Vietnam and Vietnam to the

US will be produced? As the whole machine of a cabinet needs to be disassembled

as two cabinets of parts, the transportation cost will climb.

2. How much more purchase price of local parts will be generated given the lack of

the supply chain?

3. What is the cost on local management and staffing?

4. How efficient are the local workers? Can they meet the needs of North American

customers?

5. Are there adequate local skilled workers?

6. Is the US tariff policy stable? What if the Trump administration reduces or

even cancels the tariff after these runners take pains to transfer to Southeast

Asia?

This list of problems could go on. At least six months or a year

is needed to solve them, and during this period Sino-US relations may change.

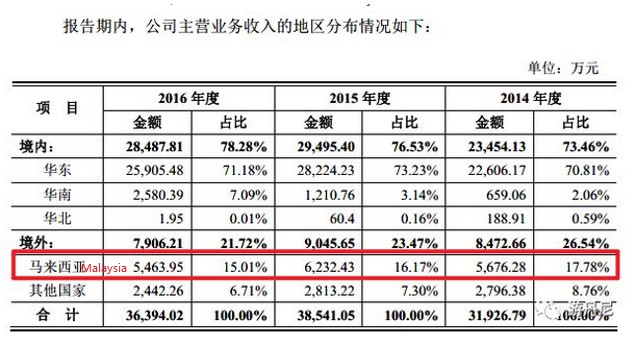

If the vacuum cleaner industry really transfers to Southeast Asia, Chunguan(CGH)

Technology will benefit most as a new listed player. This vacuum hose producer

based in Jinhua set up the GGH plant in Malaysia in 2015, to exclusively

provide Dyson with hoses and accessories.

As can be seen from its prospectus, the goods supplied to Dyson in 2016 were worth

54.63 million.

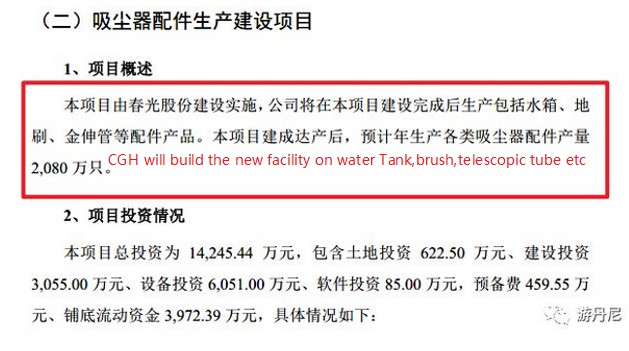

Chunguan(CGH) Technology started with the vacuum cleaner hose business, now it begins to vigorously

develop other vacuum cleaner accessories. The prospectus showed that a large

part of the funds raised will be used for the vacuum parts production project.

Once the vacuum giants transfer to Southeast Asia, Chunguan(CGH) Technology will

gain the majority of the transferred accessory orders by virtue of edges in its

Malaysia factory and years of partnership with its clients.